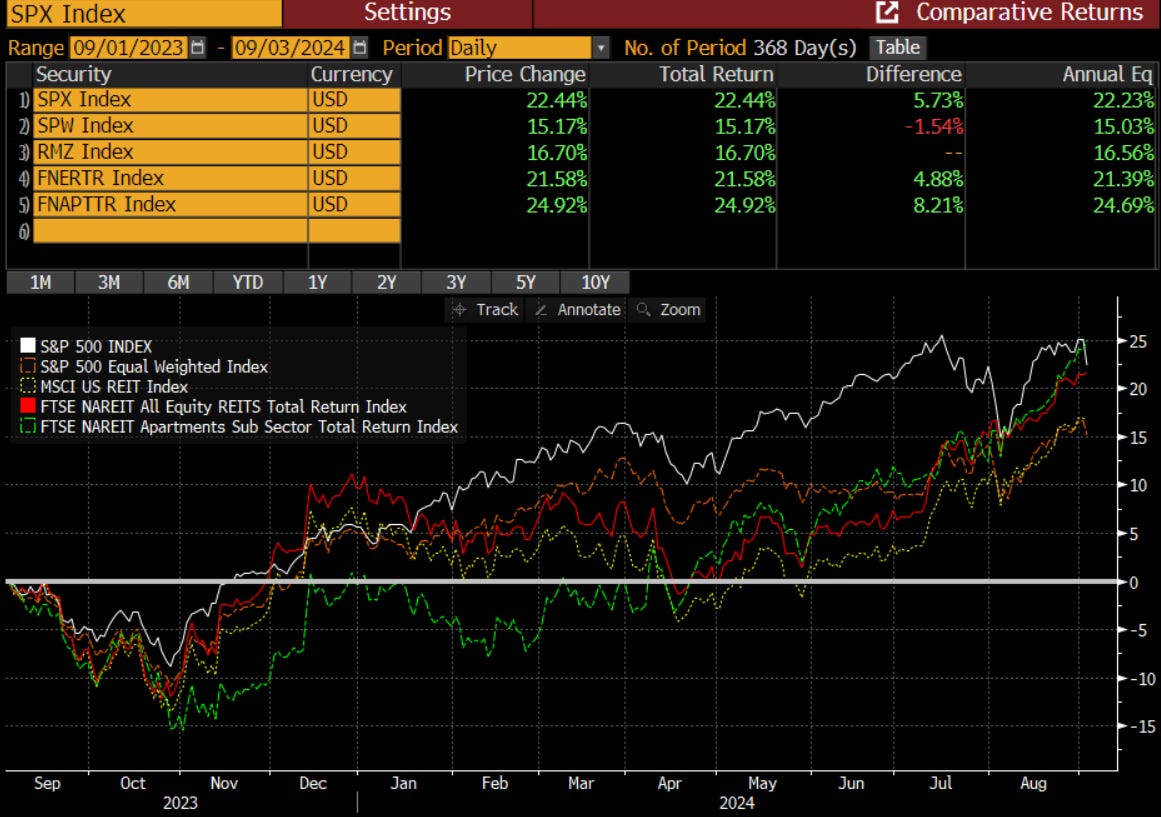

After a year in which Apartment REITs outperformed the S&P 500 and REITs generally outperformed the S&P equal weight, Morgan Stanley and Goldman Sachs have come around to the view that low-leverage listed real estate might be a good play going into a Fed cutting cycle.

Morgan Stanley on the Historical Analogs

As MS points out, REITs have been in a five-year malaise, underperforming broad equities by more than 10% annually. They blame COVID, which significantly altered demand for certain real estate types, and rapidly rising rates, which depressed transaction volumes and valuations. Those doldrums are a major contributor to the longer lookback, showing a +2% drag to the S&P, swinging a 70 basis point lead from 2019 to today’s lag.

As expected, the broad indices' red-hot performance has created a sizeable valuation divergence. Should REIT valuations revert to their long-run valuation relationship with equities, the upside is 30-40%. MS,

“Interestingly, this outperformance of broad U.S. equities versus REITs has resulted in a significant valuation discrepancy. Over the past 20 years, U.S. REITs have traded at a +0.5x premium to U.S. equities on a multiple basis, but today U.S. REITs are trading at a -4.3x multiple discount. Bringing this relationship back to par would imply between 30-40% of relative outperformance of REITs compared to equities.”