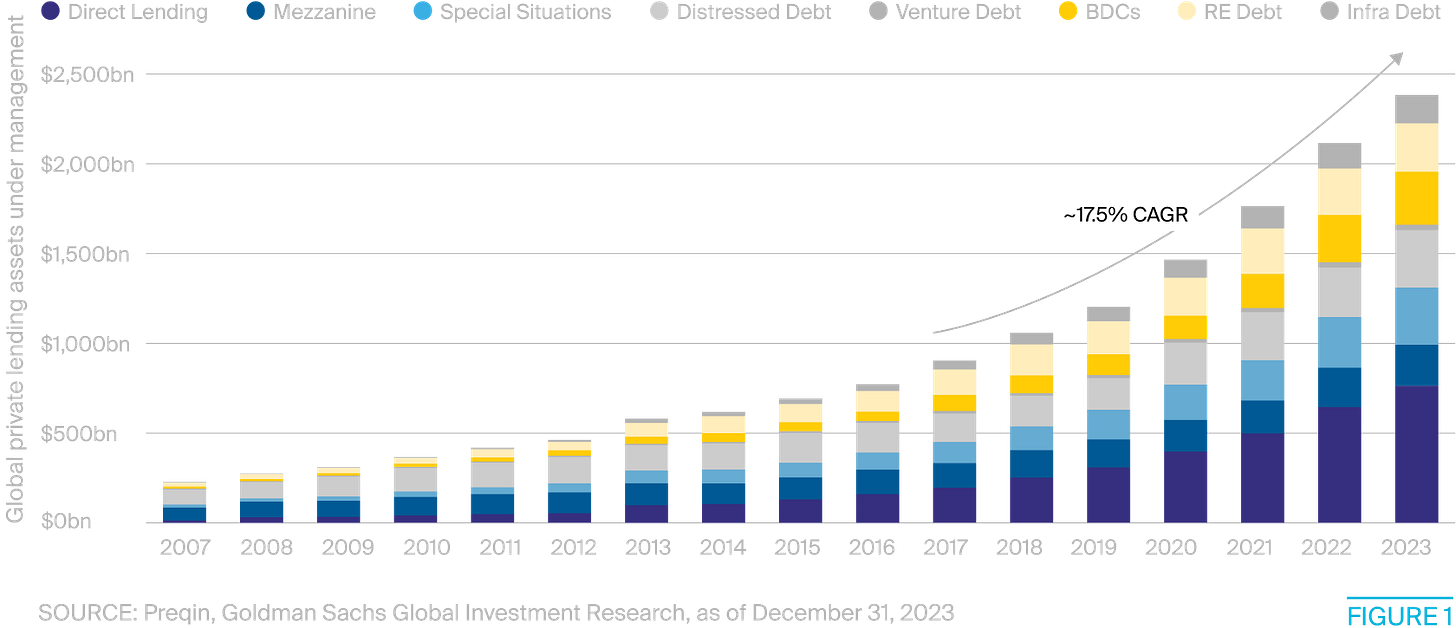

A prevailing narrative has evolved around private credit's meteoric rise from roughly $1 trillion in 2020 to nearly $2.5 trillion of assets today. It is easy to suggest that hapless allocators were lured with high yields that didn’t come with the accompanying volatility. This explanation, while convenient, misses the fundamental driver: Equity markets have systematically failed to provide accessible capital to the broad swath of American enterprise, forcing a mass exodus toward private debt markets.

I’ve written my fair share about private credit and its expansion into insurance with more than a degree of skepticism. That private credit represents some sort of growing risk has installed itself as, paradoxically, a broadly held “contrarian” opinion.

Markets of all stripes climb walls of worry, but the expansion of private credit has been particularly vexing. I’ve heard a variety of theses that private lending is the next “Big Short.” Those theories presuppose that asset growth is downstream from buyside allocation decisions and not reflective of demand from the users of capital, i.e. companies themselves.

Just as investors seek out the best risk-return tradeoffs, so too do companies seek to minimize their cost of capital. Instead of asking why investors are so eager to lend, it is just important to try to understand why companies are so eager to borrow at ostensibly high rates.

Canary in the coworking mine

When WeWork's IPO collapsed in spectacular fashion, few recognized it as a harbinger of a fundamental shift in corporate America's financing landscape. Once valued at $49 billion, Neumann’s Folly found itself scrambling for survival after investors rejected its business model and excessive debt load. By March 2023, WeWork was negotiating a $1.5 billion debt restructuring with SoftBank – explicitly stating that traditional equity financing was not viable due to market conditions. What appeared to be an isolated corporate disaster was actually the first domino in a historic capital migration that would reshape how companies fund growth.