Key Points

Industrial REITs are absorbing new supply better than expected, but lacking a clear macro tailwind to power them higher.

Sub-sector level multiples belie more dispersion within the asset class.

Size, geography and product type are important, but liquidity will be the real value diver over the next 18-24 months.

A handful of lower leverage REITs offer some compelling opportunities relative to the beta provided by the large-cap names like Prologis and Lineage.

Industrial real estate is potentially the most politically exposed real estate sector heading into the election. Trade policies and labor relations have roiled the asset class, and Industrial REITs largely sat out the REIT rally that began in late 2023.

While multifamily benefits from the structural advantages of a tight housing market, data centers ride the coattails of AI investment, and office reaps the benefits of expanding from near-death multiples, industrial looks both expensive and seemingly in search of the kind of macro catalysts that powered its post-COVID ascendancy.

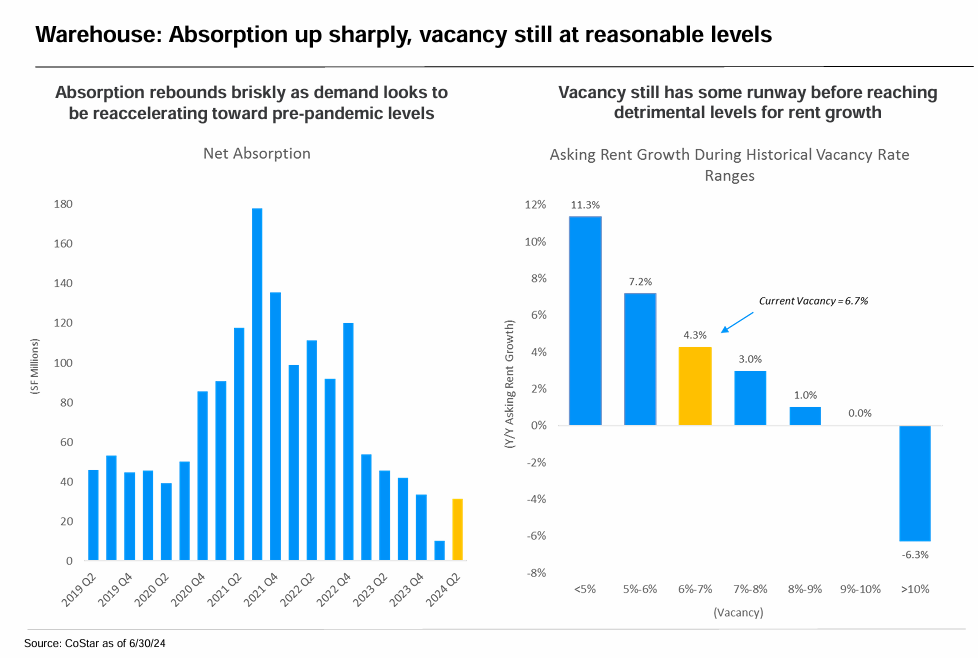

Occupany & Absorption

Despite the looming uncertainty, fundamentals remain strong as supply growth has not caused runaway vacancy. Back in January, Prologis CEO Hamid Moghadam predicted vacancies would peak around 6%. According to CoStar, “The U.S. industrial vacancy rate ticked up slightly to 6.6% in the third quarter from 6.5% in the second quarter, the smallest quarterly increase recorded since late 2022.” JP Morgan notes that absorption is normalizing to pre-COVID level, and even in a 6-7% vacancy environment, rents can still grow at above-GDP rates.

The market appears to appreciate those sturdy fundamentals, with industrial REITs trading at 20-23x trailing FFO versus 17X for the broader universe. This is partly due to robust leasing spreads as leases are marked to market. Those spreads create baseline NOI growth, assuming occupancy stays steady. As Prologis PLD 0.00%↑ said on the Q3 earnings call,

“You'll see recovery emerge later next year and accelerate into 2026... Looking ahead to next year, it's probably best to think about just the things that we know... On a net effective basis, you probably find yourselves somewhere around [5%] and then the last thing to think about is just occupancy trends. And again, things really murky to forecast occupancy from here.”

Industrial REIT GAAP & Cash Leasing Spreads

A layer deeper reveals the individual view of those leasing trends. Cold storage newcomer Lineage LINE 0.00%↑ shows a data center-like 30x multiple, while smaller industrial REITs like Plymouth PLYM 0.00%↑ trade at nearly half the comp set. Size alone does not account for this dispersion. Geographic focus and the differences between cold storage, logistics, and flex space certainly play a role.

Keep reading with a 7-day free trial

Subscribe to Lewis Enterprises to keep reading this post and get 7 days of free access to the full post archives.