Some investment theses seem self-evident. The declining affordability of single-family housing, rising mortgage rates, and an aging population made an intuitive case for single-family rentals (SFR) to become an institutional asset class. Could single-family homes be underwritten, acquired, and managed at scale? The potential profits were too beguiling not to try. Buying by the square foot and getting valued at a cap rate made for a potent arbitrage as interest rates marched toward the zero bound.

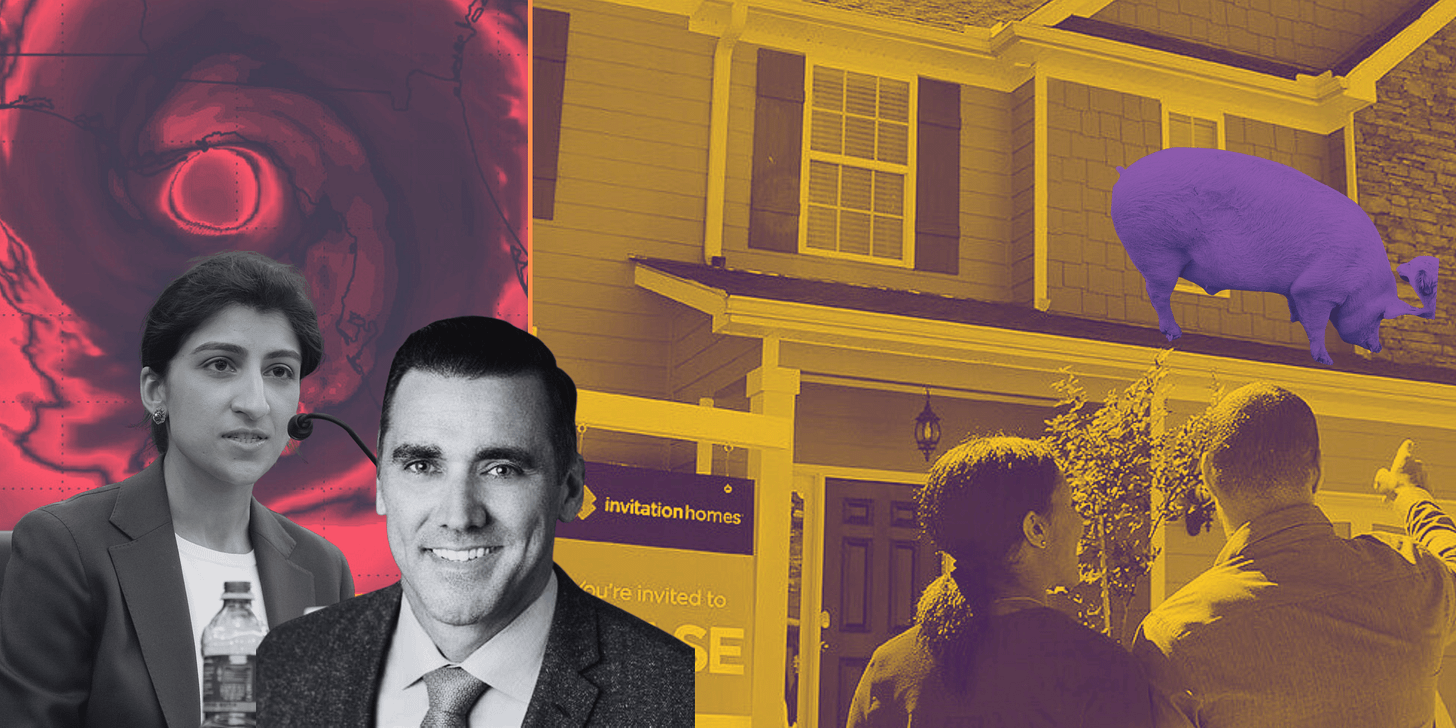

Last week, Invitation Homes, INVH 0.00%↑ , was dealt two bad hands: First, the firm agreed to a $48 million settlement with the Federal Trade Commission over deceptive rental practices. Then, a large portion of its property portfolio was in the path of Hurricane Helene, which undoubtedly damaged its homes throughout the Southeast.

Following the hurricane, several listed REITs, including NexPoint Residential NXRT 0.00%↑ , Equity Lifestyle ELS 0.00%↑ , Highwoods HIW 0.00%↑ , and Independence Realty Trust IRT 0.00%↑ , issued statements outlining the initial assessments of the impacts on their portfolios. Invitation Homes has issued no such statement. Notably, MAA 0.00%↑ and CPT 0.00%↑ have not provided an update either, but that may be because Tropical Storm Milton is gaining strength in the Gulf. Hurricane season is, after all, just beginning.

In public markets, themes with clear macro tailwinds are given the benefit of the doubt regarding their long-run operating models. Growing top lines cover a variety of sins. Across public and private markets, SFR has been granted an outsized benefit. For listed SFR REITs like INVH and American Homes 4 Rent ( AMH 0.00%↑ ), the pressures of public markets have created a growing accrual between performance and reality. The one-two punch of greater regulatory scrutiny and acute exposure to natural disasters threatens to clear those accounts.

Juicing the Hog

The essential claim in the FTC settlement related to various mandatory fees that were either egregious, opaque, or outright undisclosed. The $48 million settlement still needs to be approved by a Federal judge, but it raises the question of how important these fees were to INVH’s business.

INVH is not shy about promoting its “amenitized” homes as a key competitive advantage. Yet, they are not eager to clearly disclose what portion of additional charges they account for in their revenue figures. Charges like the now mandatory “Smart Home Fee” were a core element of the FTC settlement.

Both the rental revenue line of the income statement and the supplemental disclosures of “Core Rent” include other property income, like fees, but nowhere are they explicitly broken out from the rental figures. The growth of this revenue stream is periodically disclosed, like on the fourth-quarter 2023 earnings call where Chief Operating Officer Charles Young said,

“Same-store core revenues grew 7.6% year-over-year in the fourth quarter. This increase was driven by average monthly rental rate growth of 9.4% and a 16% increase in other property income, net of resident recoveries.”

A 16%(!) increase over what becomes an interesting question to try to answer. A brief note from Bloomberg Intelligence pegged the figure at 10% of revenue, but it is unclear where they arrived at this number, even referring to it as a “line item” where none exists.

In the notes to the financial statements, the company lists late fees and termination fees, among others, at a run rate of $180 million for 2024. From the most recent 10-Q,

“Variable lease payments consist of resident reimbursements for utilities, and various other fees, including late fees and lease termination fees, among others. Variable lease payments are charged based on the terms and conditions included in the resident leases. For the three months ended June 30, 2024 and 2023, rental revenues and other property income includes $40,077 and $37,063 of variable lease payments, respectively. For the six months ended June 30, 2024 and 2023, rental revenues and other property income includes $81,922 and $72,574 of variable lease payments, respectively.”

I believe this figure materially understates the percentage of revenue coming from fees. What INVH does disclose is the average rental rate for its same-store homes, the percentage of the portfolio that qualifies as same-store, and Core Same-Store Revenue, which includes fee income. If you multiply the same-store average rent by the number of same-store units, you can arrive at the same-store rental revenue figure. By comparing this number to the same-store core revenue, you can approximate the portion of revenue accounted for by fees and other charges.

Somewhere between 17% and 20% of INVH’s revenues may actually come from fees, at least some of which the FTC has deemed deceptive. The absolute number will be inaccurate as homes migrate into same-store status throughout the year. Still, fee revenue is a crucial component of INVH’s business model.

Some of these fees, like “application fees” or “reservation fees,” are pure profit from a property-level standpoint. While they may consume some portion of G&A, they are presumably excluded from property operating expenses.

This revenue line partially explains INVH’s impressive NOI margins even as expenses have outpaced rent growth. It explains how, until the most recent quarter, INVH had not posted negative year-over-year FFO growth since 2020. And it explains why, in 2019, when the “Smart Home Fee” was made mandatory, INVH CEO Dallas Tanner told his Senior Vice President, “Juice this hog.”

The Lawsuits

Every large company has lawsuits, and reading the complaints can paint an overly sinister portrait of a company just engaging in normal business activity. However, INVH’s court dockets show almost an institutional mandate to push fees on customers that make staying current nearly impossible and to defer critical maintenance and repairs at the tenant’s expense.

Ranesha Hunter's lawsuit against 2018-1 IH Borrower LP, an entity controlled by Invitation Homes, illustrates many of the systemic issues that led to the Federal Trade Commission's (FTC) action against the company.

The complaint begins with a dispute over a water leak in Hunter's rental property. When Invitation Homes failed to repair the leak promptly, it resulted in an unusually high water bill. The company's refusal to credit Hunter for the portion of the bill caused by their neglect led to a series of events that mirror the FTC's findings of deceptive and unfair practices.

One of the key issues highlighted in both the individual complaint and the FTC settlement is the use of hidden fees and deceptive pricing practices. In Hunter's case, Invitation Homes allegedly locked her out of the payment portal when she disputed the water bill charges.

This action prevented her from paying rent, leading to late fees and the accumulation of debt. The complaint details multiple dispossessory (eviction) actions filed by Invitation Homes against Hunter, often including fees and charges that had been previously settled or dismissed by the court. These dispossessory actions are intentionally scary for renters. They show up on credit reports and make finding alternative housing extremely difficult.

Hunter's experience with security deposits also reflects issues addressed in the FTC settlement. The complaint alleges that Invitation Homes continued to demand payment for amounts that should have been resolved through previous agreements and court orders. This mirrors the FTC's finding that the company unfairly withheld tenants' security deposits, including charging for normal wear and tear or pre-existing damages. The settlement prohibits such practices and requires Invitation Homes to establish fair policies for handling security deposits.

The lawsuit describes Invitation Homes' alleged practice of "stacking" penalties and fees, refusing to remove them even when the tenant successfully challenged them.

One of the most striking parallels between Hunter's case and the FTC settlement is the allegation that Invitation Homes continued to pursue eviction actions and demand payment for amounts that had been settled or dismissed by the court. This persistence in seeking unjustified payments, even in the face of legal rulings, demonstrates the systemic nature of the problems addressed by the FTC.

The complaint cites Invitation Homes' parent company boasting about a 22% increase in earnings due to its system that "track[s] resident delinquency on a daily basis" to assess late fees and process evictions automatically. This automated approach to fees and evictions, without regard for individual circumstances, is precisely the type of practice the FTC settlement aims to curtail.

Another suit, filed in the U.S. District Court for the Southern District of Florida, alleges that the company's negligence led to a severe mold infestation that forced Keisha Johnston-Gebre and her minor child out of their Weston, Florida home and caused significant health issues.

Johnston-Gebre's complaint paints a picture of corporate indifference to tenant welfare. According to the lawsuit, she first suspected mold in her rented home in 2021, four years after moving in. A professional inspection in June 2022 confirmed her fears, revealing mold in air vents, kitchen, floors, and bathrooms, and extensive water damage throughout the house. The inspector noted that the roof was leaking and mold concentration in the air was abnormally high.

Despite repeated complaints and the damning inspection report, Johnston-Gebre alleges that Invitation Homes failed to take any action to remedy the situation. This inaction, she claims, led to serious health consequences for her child, who developed mold-related illnesses, including asthma and rhinitis. A physician confirmed these conditions were directly caused by mold exposure and recommended immediate removal from the home.

"Despite having the financial resources to address the mold problem, Invitation Homes chose not to do so," said Faudlin Pierre, attorney for the plaintiffs. "This demonstrates a callous disregard for tenant health and safety that goes beyond mere negligence."

The lawsuit brings six counts against Invitation Homes, including breach of contract, constructive eviction, nuisance, negligence, Florida Residential Landlord and Tenant Act violations, and retaliatory eviction. Johnston-Gebre is seeking various forms of relief, including compensatory and punitive damages, return of her security deposit, and attorneys' fees.

INVH has traditionally settled these cases in lower courts, but as tenants press the issue and these cases rise through the court system, it has become increasingly difficult for regulators to ignore them.

The $48 million FTC settlement creates a fund to reimburse renters and includes an agreement to cease these practices going forward. But can INVH, considering the importance of fees and minimal capital expenditure to their margins, actually change their practices without the true economics of SFR hitting their valuation?

Should the 15-20% fee revenue shrink to a normalized 5-10%, would NOI margins be closer to 55% than today’s 67%? Does 18x FFO seem correct for a company with an expense line growing faster than underlying rents if the workhorse of additional fees suddenly comes under regulatory pressure? These questions seem to be going unasked by most investors.

The Path of Destruction

Were it not for Helene, these questions may have lingered, but the storm’s path cut through a meaningful portion of INVH’s portfolio geographies (20-30% by revenue). The company was already facing higher property tax and insurance costs, and the storm's aftermath threatens to exacerbate rising property expenses, potentially exposing the extent of the deferred maintenance on properties.