Cold Storage is commercial real estate’s perpetual industry of the future. The sector's outlook always appears bright, yet the promised future seems never to arrive.

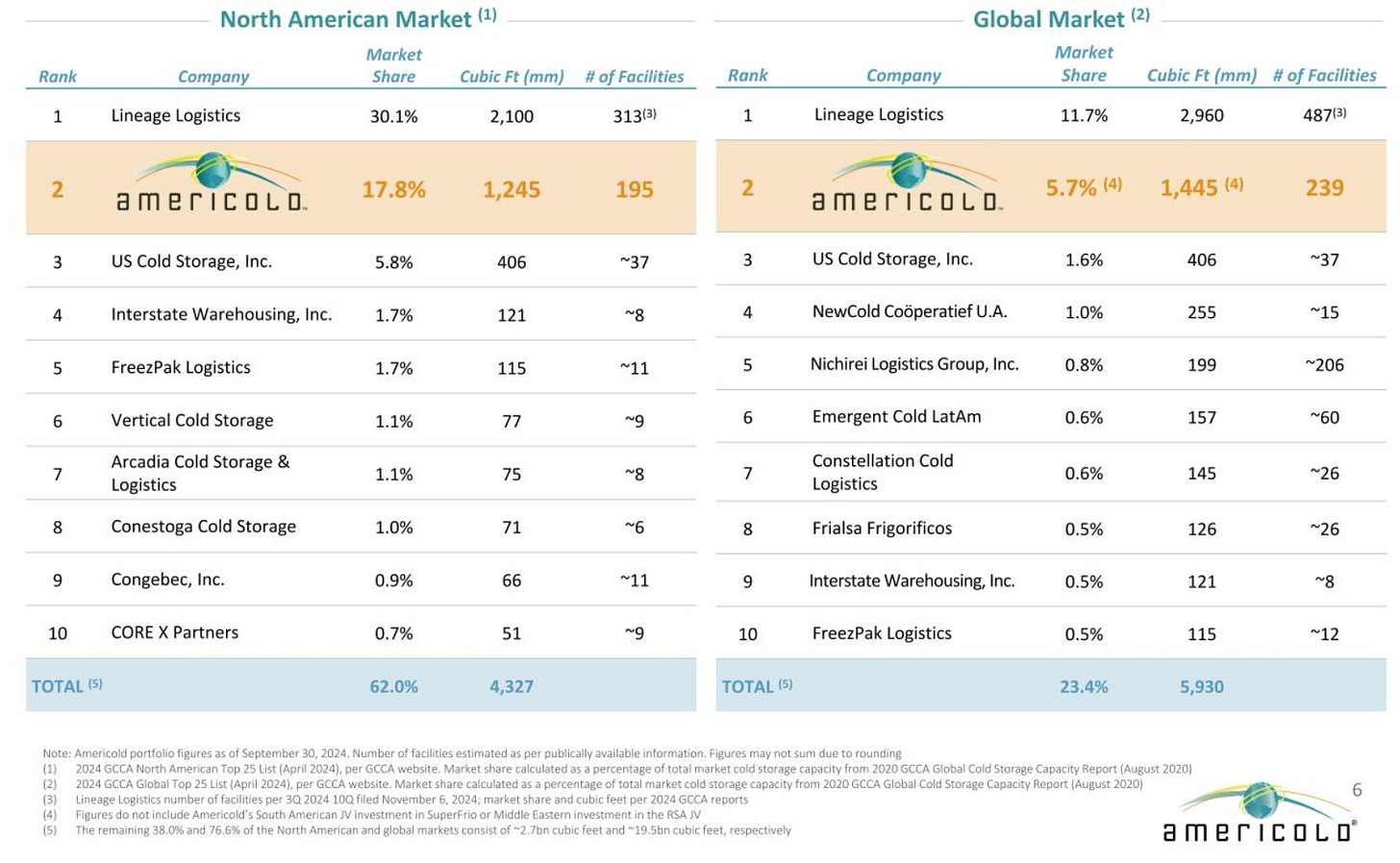

With the July 2024 IPO of Lineage Logistics LINE 0.00%↑ cold storage stands alone as a sector where listed operators represent the bulk of market share. More than 70% of North America’s cold storage supply is held by either Lineage or Americold COLD 0.00%↑.

The $160 billion global industry is expected to grow at an annual rate of 18% through 2030. While cold storage is most commonly associated with the food supply chain, it is also critically important for pharmaceuticals like vaccines and insulin. During COVID, the Department of Homeland Security even classified cold storage facilities as “essential infrastructure.” Like all industrial real estate, land constraints and high construction costs limit supply. Additionally, the added complexity of cold storage means new deliveries can take 12 to 18 months.

Despite these tailwinds and its enviable infrastructure classification, Americold has had a -17% total return over the previous five years, and Lineage is 30% below its IPO price. Understanding why these haven’t worked as public companies is key to evaluating under what conditions they could be attractive.

Volume-Based Business Models

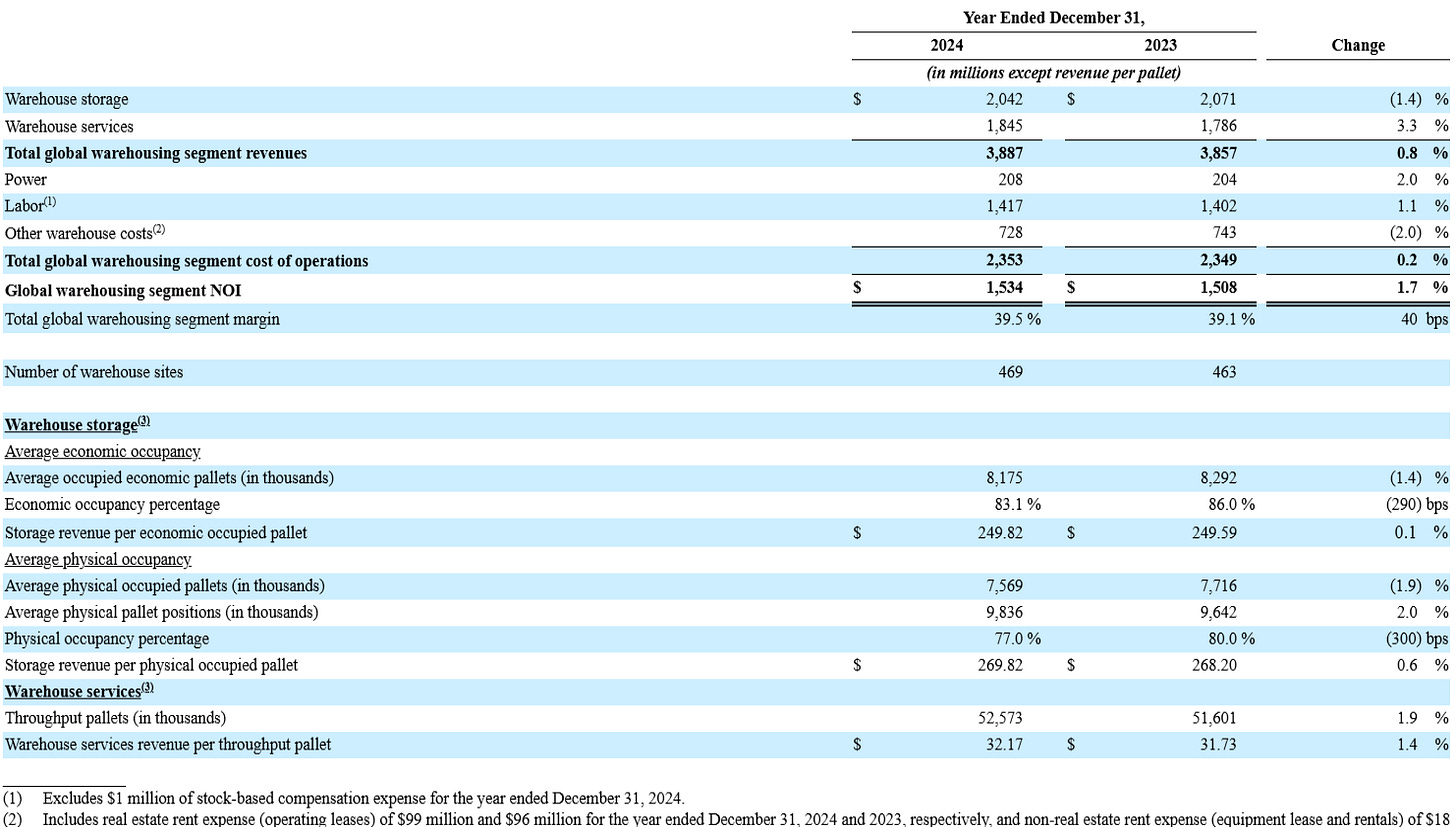

Cold storage is unique from traditional industrial in various ways, but the most crucial is that the top line is heavily influenced by actual facility throughput. Instead of leasing on a two-dimensional square footage basis, cold storage is leased and managed three-dimensionally and quoted in pallet positions. Customers pay for both the storage and movement of goods through facilities.

Lineage’s 86 million square feet of property converts to 3.1 billion cubic feet and nearly 10 million “pallet positions.” The revenue per pallet position is a mix of storage and service costs. It follows that revenue is total pallet positions multiplied by economic occupancy multiplied by the storage revenue per occupied pallet plus the services revenue per pallet multiplied by total pallet throughput. This introduces a much higher degree of revenue volatility than would be found in traditional industrial real estate.

Since Americold has a more extended history as a public company, we can compare the quarterly year-over-year change in revenue versus the year-over-year change in operating profits against a traditional industrial REIT of similar size (First Industrial FR 0.00%↑ ). As you can see, the revenue dispersion is much greater, and the relationship between revenue growth and margins is not uniformly positive.

Even this understates the variability of cold storage revenue. Lineage outlines four different types of agreements it has with its customers: