Lodging Languishes

A Fully Baked Rebound in Hotel REITs Now Faces Multiple Headwinds

Summary

Lodging has been an unexpectedly strong sector following the disruption of COVID. The depths of the drawdown gave way to an equally dramatic rebound as consumers paid up for experiential travel. In brief, I am bearish on the sector heading into the second half of the year due to a variety of trends that threaten both the top and bottom lines for hotel REITs including:

Surprisingly robust supply pipeline in markets with fading demand

Mounting labor organization that threatens higher operating costs

Antitrust momentum on pricing technology

Cost-of-capital constrained acquisition environment

A quick programming note, free Lewis Enterprises will return next week with a long overdue review of Milton Friedman: The Last Conservative.

“I think there's often times when I look at the lodging REIT industry over the last 2, 3 decades, I find that there always tend to be a little bit of groupthink in terms of the markets that got crowded around the same time. Oftentimes, when everyone's buying in one place is frankly where I wish we were selling at that time.“

- Jim Donnelly, CEO DiamondRock Hospitality

This week’s CPI report finally showed some early indications that the seemingly indefatigable American consumer may be getting stretched. Lodging had been a bellwether of consumers' appetite for services coming out of COVID, showing remarkable resolve not only in terms of demand but in being able to take price during the inflationary bout. A pent-up consumer was ready to spend on experiences, and while labor costs and supply chain issues pressured expenses, operators found ways of “adjusting” service levels to maintain profitability.

Lodging CPI (light blue line) dramatically outpaced Core PCE (green line) for most of the period immediately following COVID but has now moderated into a potentially deflationary trend.

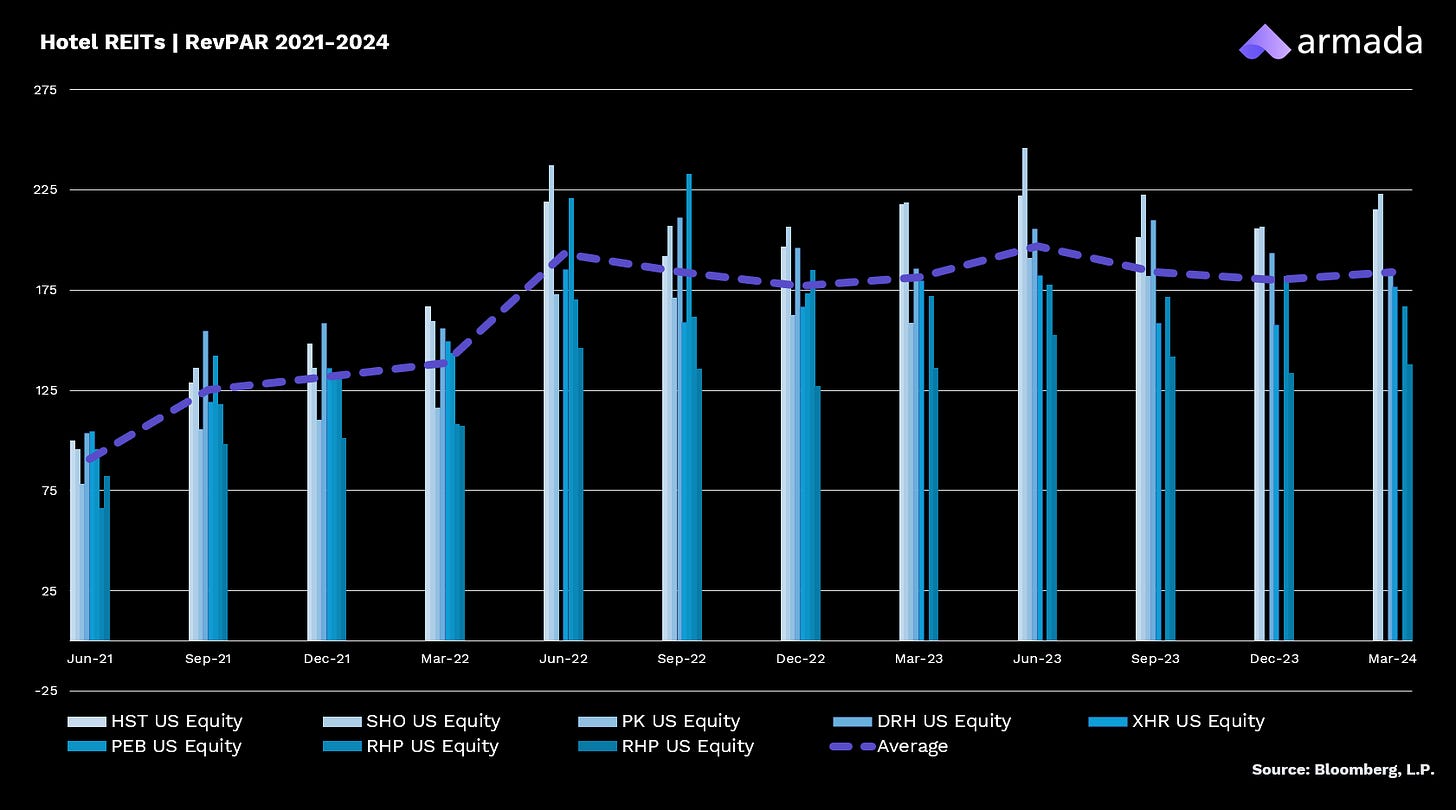

Industry-wide occupancy has returned largely to normal even as business travel and banquet business (weddings, events, etc.) have made lurching attempts at rebounding. The largest hotel REIT, Host Hotels & Resorts HST 0.00%↑ grew its Average Daily Rate (ADR) over 19% annually since the depths of COVID lockdowns in the second quarter of 2020. Host’s Revenue Per Available Room (RevPAR) is now above pre-COVID levels.

In August of last year, private equity group KSL took Hersha Hospitality private at a $1.4 billion dollar valuation and a 60% premium to where the stock was trading. In the rate-constrained transaction market, the deal looked rich. Hersha’s annualized NOI was around $110 million, the $1.4 billion deal put the cap rate around 7.8%.

According to NAREIT, the implied cap rate for the sector was closer to 9.5% at the time of the transaction. It would have been easy to say that the deal was “ringing the bell” on the top of the lodging comeback, except from that point forward Hotel REITs have outperformed the broader index.

Hawkins Entrekin provided an excellent breakdown of the bull case for hotel REITs in November here.

Supply Increasing

Today, the sector still offers attractive FFO Yields between 8-10%, but when you consider the mounting headwinds, those backward-looking yields start to look like a signal of declining ADRs, and in turn, RevPAR.

RevPAR has largely flatlined for most of the last 18 months (above) and per a report from Raymond James and Lodging Econometrics, the development pipeline for hotels is actually ramping.

“In the first quarter, 114 new hotels/15,506 rooms opened in the United States, of which 60 hotels/10,036 rooms opened in the top 50 markets. LE is forecasting these same 50 markets to open another 255 projects/30,502 rooms over the next three quarters, for a total of 315 projects/40,538 rooms in 2024.”

Keep reading with a 7-day free trial

Subscribe to Lewis Enterprises to keep reading this post and get 7 days of free access to the full post archives.