Do Public-Private JVs Make Sense?

Plymouth Industrial and Sixth Street | How Private Equity is Leveraging Public REITs

Published ahead of holiday weekend, removing the paywall and offering $100 off annual subscriptions. I am planning on upping my publishing cadence into the Fall without more timely commentary on the listed real estate market.

Long-time readers of L.E. will be familiar with my affection for Marty Whitman. His approach to value starkly contrasts with the Graham/Dodd/Buffett dogmas that have come to dominate the discipline. Whitman rejected what he called “income statement primacy,” the belief that the ability to generate accounting earnings was the ultimate judge of value. Instead, he took a credit and balance sheet approach and believed that many companies were in the business of “corporate wealth creation.” Corporate wealth creation includes many “asset conversion activities” like sales, refinances, and M&A, which create shareholder value independently of income statement flows. This is intuitive to real estate investors for whom real asset ownership provides a toolbox of wealth-creating transactions such as recapitalizations, joint ventures, and structured finance solutions.

This week, Plymouth Industrial REIT announced a joint venture with Sixth Street involving a portfolio of Chicago industrial buildings. JVs are common in REITs, but the Sixth Street deal is more complex. Its size is also notable, providing the $1 billion market cap PLYM 0.00%↑ with up to $500m of liquidity to acquire assets. This form of asset conversion is precisely the type that Whitman described as creating corporate wealth. Moreover, it reflects how private equity and listed real estate are interacting outside of the big take-private transactions Blackstone has engaged in. Private equity uses JVs to create more leveraged real estate exposure. At the same time, public REITs can unlock a portion of their asset value to grow without below-NAV equity issuance or taking on expensive debt.

The Deal

PLYM is contributing its Chicago area assets to the JV at a 6.2% cap rate on $22 million of net operating income, or $356 million. That will be financed at 50% LTV upon close. Of the 50% equity, Sixth Street is contributing $116 million or 65%. Plymouth plans to use a portion of the proceeds to pay down $67 million of existing secured debt, while their proportionate share of the new debt ($178 million) will equal $63 million, making the transaction roughly leverage neutral.

PLYM’s Chicago portfolio represents the REIT’s largest geography both by square footage and annualized base rent, accounting for nearly 20% of each. PLYM’s cost basis is approximately $260 million on these assets. The combination of the new equity and mortgage debt creates $294 million of total proceeds, recovering all of PLYM’s basis in the assets. The new JV will also generate management fees of $1.5 to $1.8 million per year, assuming a 1% fee on equity.

Value Creation

This structure generates three forms of value creation: An attractive cap rate mark, a higher equity yield, and, crucially, non-dilutive capital with which to acquire more assets.

Attractive Cap Rate Mark

The market implied cap rate for PLYM in the lpw-7s, so the 6.20% mark on 20% of the portfolio suggests some discount to NAV in the current share price. Of course, the deal's complexity, including a step-up coupon preferred and warrants, does not make this valuation a clean comparable for the assets' actual market value.

Sixth Street is getting some additional optionality and yield that a fee buyer would not, and presumably, those opportunities are an extension of the value they are willing to put on the assets. The true value of the assets would need to be adjusted for the option value of the preferreds and warrants.

The 5.9 million square feet implies a per-square-foot price (PSF) of $60.34, so what looks like a 14% value increase from cap rate compression ($22 million NOI / 6.20% vs. 7.04%) is really only a 6% premium to the implied PSF. Asking rents in Chicago as of Q4 2023 were $6.63. At a 70% NOI margin, the mark-to-market value is closer to the current implied cap rate.

Nonetheless, I see the value in creating a strong headline cap rate figure, even if the financial engineering obscures it.

Improved Yield on Equity

While Plymouth is selling off some cash flow, it actually somewhat improves yield even while keeping the overall leverage profile unchanged. Assuming stable FFO margins and factoring in an 80% margin on a 1% management fee, the cash yield improves by 230 basis points compared to being fully consolidated with no management fee.

Moving assets to a JV with something closer to a private equity structure is relatively standard in REITs, especially for development assets. The incremental fee revenue has a higher margin than the cash flow you give up, boosting yields. It also frees up the balance sheet to make acquisitions. Essentially, PLYM sold 65% of the asset but only 57% of the revenue.

Non-Dillutive Capital

The real beauty of this deal is that PLYM gets access to capital without having to issue equity immediately. The JV allows them to unlock a portion of the Chicago Portfolio value to pay down debt and, more importantly, acquire assets with attractive yields.

At 35% ownership, the JV will be unconsolidated, yet in the press release, management affirmed its full-year guidance of $1.88 to $1.90 per share FFO. By my calculation, the Chicago assets accounted for around $0.30 of FFO; at a proportionate share, they will only contribute $0.11. How is the $0.20 FFO being bridged? Presumably, by new acquisitions.

Plymouth has already earmarked some of the new capital for its recent $100.5 million acquisition of a Memphis portfolio purchased at an 8% cap rate. Plymouth has identified additional acquisitions with above 6% cap rates, lease-up upside, shorter WALTs, and more embedded mark-to-market rent increases. The Memphis portfolio alone should contribute around $0.10 to FFO. Plymouth needs a combination of NOI growth in its legacy portfolio and another $100 million of acquisitions to hit guidance -- something they apparently feel confident about.

What Does Sixth Street Get?

This all, of course, comes at a cost. The relative value of which will only be known in time. Sixth Street’s $140 million preferreds have a 7% yield split between a 4% cash pay and 3% PIK; those step up in Year 5 to 8% and 4%, then again in Year 7 to 12% and 4%. As John Kim of BMO writes,

“This is deja vu for PLYM, which recently eliminated the overhang from Series B Preferred shares (which were convertible to equity). In this case, the overhang is the potential increased costs…Even if PLYM were to redeem before the fifth anniversary, the implied cost would exceed 7% per annum, as Sixth Street is entitled to a 35% total return inclusive of dividends.”

This deal implicitly assumes that rates will fall, allowing PLYM to exit the preferreds before their costs rise. As Year 5 comes into view, the overhang from preferreds could again be an issue for PLYM.

Sixth Street also gets 11.76 million warrants with strikes at $25.25, $26.25 and $27.25. These are, in effect, forward purchase agreements of stock. Sixth Street likely sees the acquisition pipeline as growing FFO and, in turn, share price. If PYLD were to deploy $400 million into 6.5 cap assets, undiluted FFO per share would increase by approximately 20% (~$0.30). That said, the prospective dilution from the warrants qualifies as a contingent cost of capital.

Is this a good deal?

Time will tell, but I understand the logic and motivation of both parties. REITs are structurally equity issuers since their capital allocation is constrained by the dividend requirements. Absent distress, management is loath to issue equity at what they believe is below NAV.

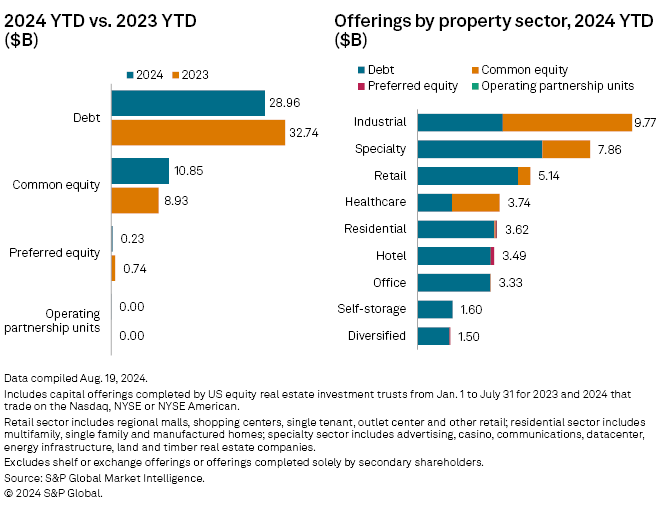

Similarly, debt capital markets are not currently offering a great alternative. The REIT rally has given some companies an opening to issue equity, but debt offerings are pacing below 2023. It is worth noting that $4 billion of this year’s equity issuance is attributable to the Lineagem LINE 0.00%↑ IPO.

Yet, REITs must grow and debt-laden private markets are offering accretive acquisition opportunities. These structured JVs free up capital to make acquisitions without committing the balance sheet sins of poorly timed debt or equity issuance.

For its part, private equity can use its more patient (read: illiquid) capital to create real estate exposure that more closely matches its target leverage profile by structuring PIPEs into assets already managed at scale.

Knowing the cost of this capital ex-ante is difficult, if not impossible. This added complexity comes with the risk of growth being more punitively discounted. For REITs, greater complexity rarely leads to valuation premiums for all but the largest players.

Overall, I think the Plymouth-Sixth Street deal makes sense, and if the market disagrees and pushes the stock price further from the warrant strikes, it could be an attractive opportunity. Further, we should expect more deals like this as transaction volume picks up and the ever-looming “maturity wall” slowly dispenses opportunity.

Hi Hunter

Thanks for the article.

Happy to have a call with you about this topic and the company. Let me know if you would be available.

Best regards

Hernán