Summary

The constantly looming threat of the “Wall of Maturities” for commercial real estate debt presents an opportunity for listed REITs. That opportunity comes largely from the cost of capital advantage provided by low-rate corporate-level unsecured debt. Public REITs deftly used low rates to buttress their balance sheets with relatively long-term fixed-rate debt during the last Fed cutting cycle. Lower-cost debt financing presents public investors with two key questions:

Does the future refinancing of this debt create a potential headwind for FFO and, in turn, equity multiples?

Are there attractive opportunities higher in the capital stack if stagflation is the prevailing macroeconomic thesis?

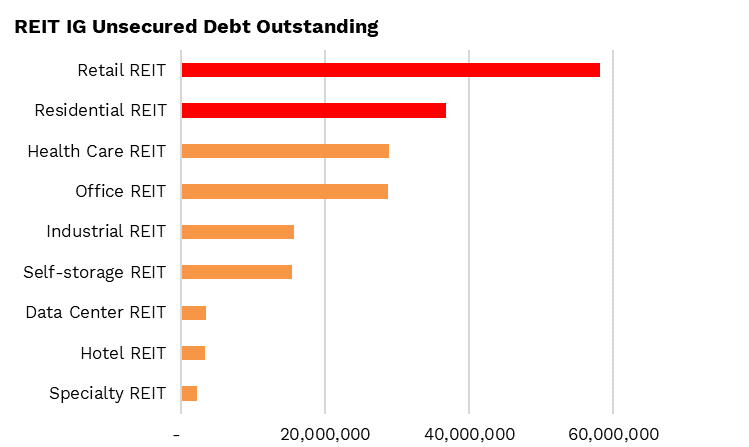

I am going to focus on investment-grade REIT bonds. There are no doubt some juicy special situations lurking in high-yield REIT debt, but they are highly idiosyncratic (mostly office) and hard to assess on a sector level. All data is aggregated from the Bloomberg Investment Grade US REIT Index (I00689US Index). This index excludes Telco/Tower REITs.

Issuance

As rates fell, REITs ramped their debt issuance, raising $66 billion in debt capital over 2020 and 2021 at an average coupon of 2.64%.

Residential and Retail REITs have the most debt outstanding, with coupons between 3.50% and 4.00%. These sectors are also the beneficiaries of demand tailwinds and the capital cycle. Retail space is structurally undersupplied after a decade-plus of tepid construction. According to CoStar,

“Over 80% of retail spaces listed on the market during the past year were leased within six months of first becoming available, while 98% were leased within nine months. This is the most rapid pace on record and is more than double the average from the past decade.”

Keep reading with a 7-day free trial

Subscribe to Lewis Enterprises to keep reading this post and get 7 days of free access to the full post archives.