Post-GFC, the real estate industry has exemplified the effects of rate-driven capital cycles. The headwinds now facing the industrial and multi-family sectors are an environment Senior Living operators have lived through in recent history. Drawn in by a broadly understood demographic trend, fueled by declining interest rates and subsidized by the availability of Agency debt, Senior Living experienced a flood of capital that sent deliveries of new senior living facilities in the lead-up to COVID to their highest levels since the early 2000s.

This new supply was delivered right into the jaws of the COVID-19 pandemic, spiking the euphemistically termed “move-outs,” wrecking absorption and jump-starting the wave of distress now facing the sector.

Today’s report will focus on how one particular operator in the space, Sonida Senior Living ( SNDA 0.00%↑ ), and its capital partner Conversant Capital, are navigating the environment. SNDA is a useful case study in strategically navigating balance sheet challenges and effective engagement with an outside capital partner.

To stay focused on the financial elements, I will not delve deeply into product types or the differences between Independent Living, Assisted Living & Memory Care, nor will I make major distinctions between Private Pay and Medicaid residents. These are crucial factors, but better information can be found in the many readily accessible industry primers online.

It is also worth noting the headwinds facing the sector: Expensive staffing, pockets of negative public perception, and rising regulatory pressure put many question marks around long-range assumptions. Yet, some form of these challenges face every business and their relative acuteness in senior living is a well-circulated narrative that feeds the capital cycle I am about to describe.

OpCo/PropCos and Senior Living Capital Cycle

Senior Living (SL) is one of the most operationally intensive real estate sub-sectors. Like lodging, the industry is fragmented with great diversity of owners and operators. It similarly fissured with a mix of real estate owners, operators, and owner-operators coexisting in a myriad of structural combinations.

Because of certain restrictions within REIT tax-election around income from operating companies, Senior Living REITs must outsource a large portion of community management to operators. These operators are contracted as fee-based managers or operate under a master or net leases with the real estate owner. While this OpCo/PropCo divide is a requirement of REIT status, many private equity owners take a similar approach. As a result, operators have historically viewed leasing as a form of business financing.

For an asset class where NOI margins are more commonly 25-35% (versus 60-80% in multifamily) this can, and has, created fragile capital structures at both the OpCo and PropCo level. Real estate owners used agency debt to push aggressive LTVs, while operators used leasing to grow their businesses quickly. Combined with procyclical supply additions and exogenous disruptions like COVID, capital found itself offsides as declining occupancy rippled through these structures causing waves of distress.

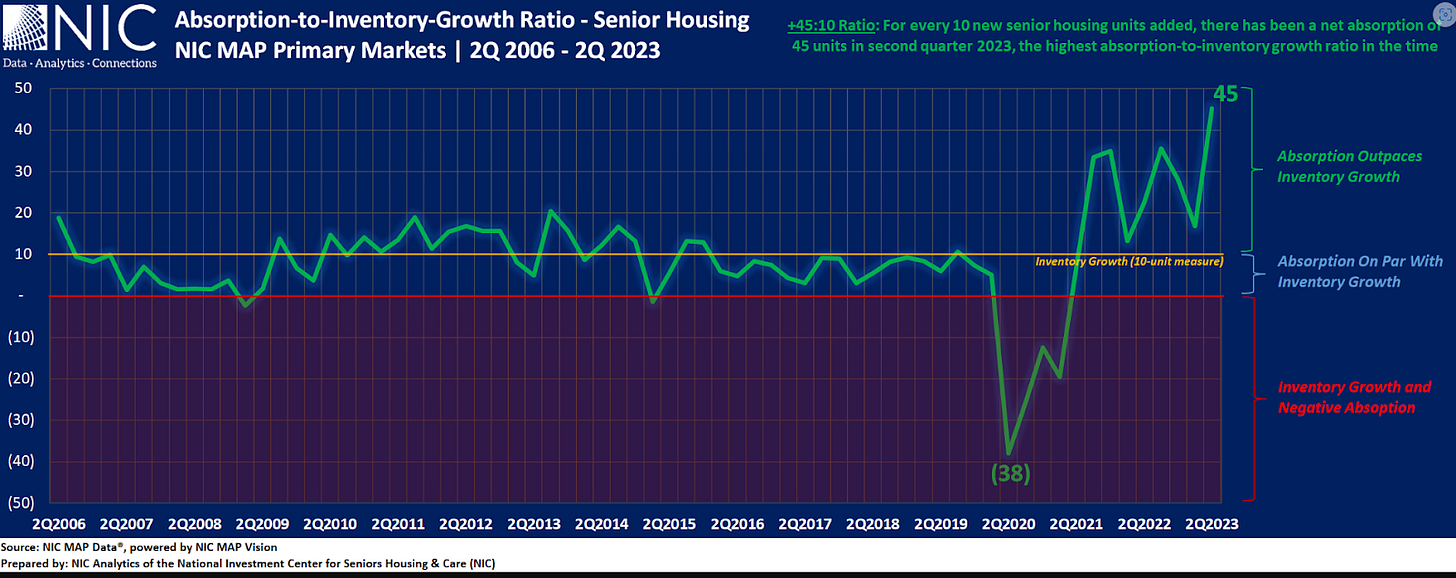

As described by Conversant’s Mike Simanovsky on Invest Like the Best, and captured visually below, Senior Living

Senior Living’s relative outperformance during the GFC caused overbuilding. That surge in supply is now being absorbed, but the broken balance sheets of operators and owners have run up against a bottoming of the capital cycle.

Rising rates have also played a role in accelerating these issues, data from Freddie Mac shows the collapse in debt-service coverage ratios (DSCR) on floating-rate loans to Independent Living (IL) and Assisted Living (AL) facilities.

The financial impact on owners is occurring just as supply growth is tapering and the demographic transition is ramping. According to the Wall Street Journal, “occupancy rates at private-pay senior-housing communities are closing in on where they were before the pandemic. In the fourth quarter of 2023, the average rate was at 85.1% in the 31 largest U.S. markets,” that’s up from a pandemic low of 77.8%. Americans 65 years old and above will grow to 21% of the population by 2030, up from 15% in 2016. In brief, it is a fantastic environment for counter-cyclical investment in senior living.

Sonida Senior Living Transformation

Originally founded as Capital Senior Living Corporation, by James A. Stroud in 1996, the company quickly established itself as a prominent player in the senior living industry. The company went public on the New York Stock Exchange in 1997 under the ticker symbol "CSU." Through strategic acquisitions, including 26 communities from Health Care REIT, Inc. in 1999, 18 communities from Lehman Brothers for $130 million in 2005, and 17 communities from Prudential Real Estate Investors for $200 million in 2006, Capital Senior Living significantly expanded its portfolio and geographic presence.

In the glow of solid performance through the GFC the company found easy access to capital markets, securing a $101 million revolving credit facility with Bank of America in 2008 to support its growth initiatives. CSU continued its expansion in 2011, acquiring nine communities for $27.5 million. In 2015, the company raised $152 million in a public offering of common stock to fund further acquisitions and development projects.

From the nadir of 2009 to the end of 2015, the company’s stock rose 754% (37.30% annualized) to a split-adjusted price of $280 per share. By 2019 CSU was operating 126 communities, 80 of which were owned and another 46 leased from Ventas ( VTR 0.00%↑ ), Welltower ( WELL 0.00%↑ ), and Healthpeak ( DOC 0.00%↑ ). The supply wave was already causing occupancy challenges leading up to COVID. By the end of 2019, the company had just $5 million of Cash from Operations against a $47 million interest burden.

It wasn’t only debt costs burdening the company, by this point labor costs in the space were already exploding, and operating margins suffered as the top line fell. The company began rationalizing in 2019 terminating its master leases with the REITs (costly) and began negotiations with Fannie Mae on facilities that could no longer cover their debt. Ultimately, CSU handed back the keys to 18 facilities. Combined with the reduction in lease commitments the company reduced liabilities by $469 million, improving cash flow by $32 million.

At the time, the Fannie default was viewed as near existential, as many believed the company would forever be shut out from Agency financing. Between the end of 2015 and the first quarter of 2020, the stock fell 97%.

Enter Conversant

“Don't do distress for the sake of it, do it because you're excited about the opportunity to own the asset for a long period of time.” - Mike Simanovsky on ILTB quoting Doug Silverman.

Conversant is a unique real estate investment firm in that it looks across the private and public spectrum, approaching opportunities with a degree of agnosticism around structure. The firm considers its investments platforms and holds them in the form that best serves the underlying business. Conversant’s investment in Capital Senior Living demonstrates the power of working through distress within a public structure.

Conversant’s involvement was first disclosed in Q2 2021, the finalized transaction consisted of $41.25 million of common stock, $41.25 million of newly designated preferred shares, a $50 million backstop on a $72.3 million rights offering to existing shareholders, and a $25 million accordion. Conversant’s investment not only provided ~$150 million of liquidity to begin addressing the balance sheet challenges, it also brought their experience working with creditors and positioned the company to play offense as the distress began to play out through the sector.

Focusing on high-quality, owned facilities would give CSU better cost control and higher returns on capital invested into facilities. The vision for the company was in the mold of Conversant’s “platforms”: Build an owner-operated senior living machine that could acquire new communities as the industry recapitalized and the demographic tailwind took hold.

Conversant’s first step was a leadership refresh. Conversant brought in new CEO Brandon Ribar, a senior living operations expert, and added cross-functional board expertise. Board appointments included Ben Harris, formerly CEO of Link Logistics, Dave Johnson, founder of Aimbridge Hospitality, and Jill Krueger, CEO of outcome-based healthcare provider Symbria.

The Board now had expertise that represented the value chain of senior living: Health Care, Hospitality, and crucially, experience engaging with real estate capital providers. In 2022, the Board appointed Kevin Detz as CFO. Detz, another Aimbridge Hospitality alum, had overseen a massive expansion that catapulted Aimbridge to be the world's largest hotel management company by property count. Conversant was building a team that could put the company into growth mode. They changed the name of the company to Sonida Senior Living with the current ticker SNDA.

Fixing the Balance Sheet

Conversant’s capital injection helped solve near-term liquidity challenges, but longer-term issues loomed, including renegotiating with the previously scorned Fannie Mae. With a new sponsor, new CEO & CFO, and refreshed board, Sonida could reasonably engage with Fannie Mae as a substantially new company from the one that previously defaulted. In July of 2023, the company announced significant loan modifications with Fannie:

All maturities were extended to December 2026 or beyond

The previously amortizing loans would go to interest only for three years or waived until maturity

Interest rate reductions across all 37 mortgages

In February of this year, with another $47.5 million common equity investment from Conversant and room on their credit line, Sonida was able to purchase $74 million of outstanding fixed-rate loans from Protective Life Insurance at a 48% discount to par. The Fannie loan modifications and the elimination of the Protective Life loans reduce interest expenses by between $8-15 million annually between now and 2029.

The company was able to drop going-concern language from their full-year 2023 filings. Finally, at the beginning of April, the company announced a $75 million at-the-market offering. From the February 8-K, the stock rose from $9 per share to over $32 today.

Sonida Today

As then Capital Senior Living hit peak distress post-COVID, it is reasonable to assume a variety of capital partners were looking at ways to get involved. In these situations, it is not unusual for distressed investors to create capital structures that optically repair the balance sheet, but at the expense of common equity. Financing companies through new mezzanine securities can alleviate liquidity concerns, but create misalignment with shareholders through terms that eat future upside. By contrast, Conversant’s partnership created substantial alignment with common equity, both through outright purchase of common equity shares but also funding commitments that helped move conversations along with creditors.

Conversant didn’t only partner with management, they also won the buy-in of existing shareholders. Arbiter Partners was a 13% beneficial holder of the shares when Conversant got involved. They voted in favor of the transaction, remain a Top 5 shareholder, and have increased their position since 2021. As of their most recent 13-F, Sonida was Arbiter’s second-largest holding.

Since Q2 2021, total long-term debt has been reduced by $244 million while enterprise value has grown by $68 million. On the latest conference call, CEO Brandon Ribar laid out the strategy for the now growth-focused enterprise,

In the current environment, we see opportunistic investments as most compelling and are focusing largely on underperforming but quality assets at significant discounts to replacement costs. While these assets may be cash flow neutral or negative upfront, Sonida identifies situations where our systems and processes can structurally improve margin as well as quality of care and resident experience, and we anticipate stabilizing at double-digit NOI yields on cost. We believe that the financial success of a community is first and foremost dependent on having a strong local leadership team and key to our success is the hiring and retention of great talent that together with Sonida's tools and programs, can stabilize challenged assets.

Sonida is already working on acquiring four additional communities from a private equity seller in Texas. Sonida has focused on building and empowering regional teams that can quickly integrate new facilities onto the platform. Operationally, reducing turnover through this regional leadership model is crucial for reducing labor costs and driving occupancy, both of which are accretive to NOI margins. Ribar,

Over the past 1.5 years, we've changed the culture of the organization by empowering key regional and local leaders. This cultural transformation has resulted in 100% retention of our regional operations and sales leaders and improved our community leadership retention by nearly 10% year-over-year.

Unlike REITs, by owning operations the company can look at properties that may not be cash flowing, capitalize on discounted pricing, improve occupancy and margin, and bring the facility onto a balance sheet with what is likely among the industry’s lowest cost of capital. Conversant has overcapitalized the balance sheet, and through its convertible preferred and warrant holdings is incentivized (alongside management) to use that capital for growth.

While crucially not a REIT, SNDA can use its common equity similarly: Issuing shares when they are at a premium for accretive acquisitions, or buying back shares when they are at a discount. As the largest equity holder (54.61%), Conversant’s alignment helps ensure these forms of capital allocation are thoughtfully executed.

To better understand the transformation and platform value of Sonida, it is useful to look at the numbers on a per-owned facility basis. The estimated next 12-month (NTM) numbers below assume only the acquisition of the four communities in the pipeline today, occupancy improving to 87%, and NOI margins of 30%. While the company is not providing guidance, at year-end over half of the portfolio had already achieved occupancy greater than 90%. The equity price today on a per-facility basis implies an 8.29% cap rate.

Looking at industry estimates of Senior Living cap rates, today’s valuation is ~100 basis points wide and ignores a long-runway of accretive acquisitions and the yields achievable if they can be acquired via discounted loan purchases.

Assume, for example, a facility purchased in 2021 for $13 million with a 65% LTV loan. Today that facility may be worth $10 million at a 7 cap, but it is not cash flow positive and unable to service its debt. If Sonida could acquire the loan at a 20% discount, its NOI yield would be 11% before making any operational or margin improvements.

But this is not exclusively a roll-up story, which could be upended by a sudden return of capital to the space or unpredictable easing of capital markets. The supply pipeline in concert with demographic trends means reasonably high visibility on mid-high single-digit rent growth. Trends like “aging-in-place” only change the timing of senior living demand but the demographic trend is manifest. Supply cycles are similarly long -- senior living facilities have a higher cost per square foot to build, as such they are less attractive relative to higher-margin multi-family development.

Assuming 5% organic growth in topline with 30% NOI margins and another 5% of inorganic growth over the next 5 years provides a low-teens IRR with no cap rate compression and maintaining the current leverage profile.

Conclusion

“I think what's so interesting to me is at the peak of the capital cycle, investors tend to be the most optimistic and they extend their duration. So they look far out to get the required return. There's a lot of imagination required in that. And I'd say, as fundamentals are deteriorating, naturally, you're seeing asset values change. You're seeing multiples or cap rates in the case of real estate change and you're seeing meaningful asset value or share price underperformance. And then ultimately you get to the bottom of the capital cycle where investors are max-pessimistic with the shortest possible duration possible. And to us, that's an interesting lens to think about real estate.” - Mike Simanovsky on ILTB

If you are inclined towards this capital cycle view, senior living is perhaps one of the few opportunities in real estate offering a bottoming capital cycle. Office is arguably also at an extreme capital cycle low but with a much hazier demand outlook. Meanwhile, record levels of dry powder continue to chase deteriorating multifamily and industrial returns. Senior Living REITs and private equity owners each face constraints that prevent them from fully capitalizing on the opportunity.

REIT’s inability to have fully captive operations limits their capacity to acquire non-performing facilities and add value, while private equity owners must contend with fixed fund lives and non-strategic access to capital markets. Sonida offers a unique opportunity available in the public markets to gain counter-cyclical exposure via a structure with liquidity and a cost of capital advantage in the space.

Disclosures

This report is intended to be educational and entertaining, not investment advice. Do your own due diligence. I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report.

Any assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date hereof and are subject to change without notice. Any projections contained in the report are based on several assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Lewis Enterprises is not acting as your financial advisor or in any fiduciary capacity.

At the time of this writing, I do not own any shares of Sonida Senior Living. My own positioning is subject to change without notice.

More Capital Cycle Reading

The Chicken Cycle

Clichés about the business cycle abound. Epitaphs like “the four most dangerous words in investing are ‘this time is different’” or “history doesn’t repeat, but it rhymes” are almost painful to type. Their triteness comes less from their content and more from their usage: As a stand-in for actual analysis or insight. The capital cycle, the boom and bust of commodities or high-growth companies, is an imprint on the market yet vanishingly few seem capable of profiting from it.

Devils Take the Hindmost

What happens at the bottom? After the speculative mania has been identified, after orderly de-risking has given way to panicked selling, after the seductive illusion of a new paradigm is shattered, what are the hallmarks of The End of The End of the bubble?