A debate in multifamily real estate quietly rages: Was sunbelt growth an anomaly? The migration patterns are clear. Substantial numbers of people left gateway coastal markets and headed to the greener (and cheaper) pastures of America’s Southeast, Texas, and Arizona. The reasons given for this demographic reshuffling included political narratives, an evolving remote work economy, and less volatile prospects than “company towns” like Los Angeles, San Francisco, or New York, where growth tends to track closely with media, technology, and finance.

Despite the desire to assign these trends to large paradigm shifts, the Bank of America Institute presents a far more banal picture. Most of the migrants were young people who moved to these places overwhelmingly because they were simply cheaper.

Yes, it turns out that those “fleeing” California were less millionaires concerned about progressive policies and more likely bartenders who no longer wanted to live with four roommates. That has implications for the sustained growth of Sunbelt markets. There is an argument that young, creative types may imbue these markets with the cool factor needed to attract high earners. Still, recent growth has not been powered by the high-earning demographics that create sustained demand.

While this may be a case of mistaken causality, the underlying trend is itself telling. Housing is most people’s largest non-discretionary expense, and when it gets too burdensome, they are forced to move somewhere where the burden can be more easily shouldered. Despite the wave of supply coming to these markets, rents are still high and rising. Bully for those owners…for now, but they may be undermining their relative affordability and, thus, their growth.

Both Gen Z and Millennials are delaying household formation. Increasingly informal work arrangements mean these new residents are less likely to have put down roots. If rents in these markets no longer represent a relative value, they will migrate to new geographies. Overall, I am still bullish on the multifamily space in public markets, but that is largely a value, not growth-driven, view.

Zooming out, the Midwest offers a compelling case assuming wages stay stagnant, housing remains unaffordable, and young people accept a more rootless existence. Bleak? Perhaps, but overall, this view is more grounded than fantasies about cultural or political shifts driving migration. I am particularly bullish on the upper Midwest, specifically Centerspace CSR 0.00%↑ .

Centerspace

Centerspace is perhaps the only listed REIT that offers targeted exposure to cheaper but still economically stable Midwest markets.

With a market capitalization of just over $1 billion, the REIT owns 72 apartment communities with 13,000 units. Apartments in Denver, Minnesota, and North Dakota make up most of their revenue. The portfolio-wide average rental rate is $1,566 per month. This compares favorably with the closest Sunbelt operator, NextPoint Residential’s NXRT 0.00%↑ $1,517 monthly rates. NXRT, also around $1 billion in market cap, owns Class B properties in some of the hottest markets in the country. NXRT provides mid-point rent growth guidance of 2.30% versus 3.75% guidance from CSR. When you look at valuation, these profiles are trading at very different levels1.

The 166-basis-point 68-basis-point implied cap rate spread between CSR and NXRT over-indexes the lower growth of CSR’s markets versus the Sunbelt. While no one is suggesting that Omaha or Minneapolis are the next Nashville or Austin, the foundations of growth in these markets clearly have more upside. Rent growth in Grand Forks, North Dakota, an hour north of the relative metropolis Fargo, compared to Nashville, Tennessee, tells the story.

On a rent-per-square-foot basis, Grand Forks averages $1.12 versus Nashville’s $1.78. A 60% premium to live in the Home of Country Music? Did some wealthy New Yorkers find Nashville’s southern charm beguiling enough to move there post-COVID, sure, but again the statistics suggest that the bulk of migration-driven rent growth came from younger, budget-constrained residents making a quality-of-life tradeoff.

What areas like Grand Forks lack in name-brand appeal, they compensate for in affordability and economic stability. North Dakota's unemployment rate is 2.6%, compared to the national measure of 4.3%. Rent-to-income ratios in Centerspace markets are 21%.

Operating Advantage of Smaller Markets

Operating in these markets has other benefits for real estate owners. On their second-quarter earnings call, Equity Residential’s EQR 0.00%↑ CEO Mark Parrell said property taxes accounted for 45% of their expense load. Centerspace’s real estate taxes account for just 11% of total expenses. These markets also have slower expense growth, which is especially important for SMID Cap REITs with less inherent operating leverage. CSR has the top-line growth of a smaller REIT with the expense growth profile of its large-cap competitors.

Cost of Capital and Leverage

For better or worse, CSR is leverage-averse. It has run less than 1x Debt/Equity since 2016. Its ~7x Net Debt/EBITDA looks puritanical compared to NXRT’s 10x or Elme Communities’ 9x. CSR uses roughly an even mix of secured and unsecured debt. In the second quarter, the company issued shares 540,000 shares, raising $36 million to reduce the floating rate portion of their balance sheet to less than 2% of total debt, in turn reducing their blended cost of debt capital to 3.49% from 3.62%. Centerspace CEO Anne Olson,

“During and subsequent to the quarter, we issued shares on our ATM with proceeds of approximately $37 million at an average gross price of $69.60 per share, which we are using to reduce leverage. These sales are a positive contrast to our first quarter stock buybacks at an average of $53.60 per share.”

This share issuance should also be accretive to FFO, adding $0.04 in Q3 when the interest savings flow through, accounting for the increased share count. Management suggested they may pay off the remaining $10-$20 million of floating debt.

This patently Midwestern prudence necessarily constrains its returns on equity and, in turn, its multiple. CSR is fundamentally less levered to interest rates, both by virtue of its stable underlying markets and its conservative balance sheet. Compared to significantly more levered NXRT, CSR has a higher return on its assets, but its unwillingness to press its leverage reduces returns to equity.

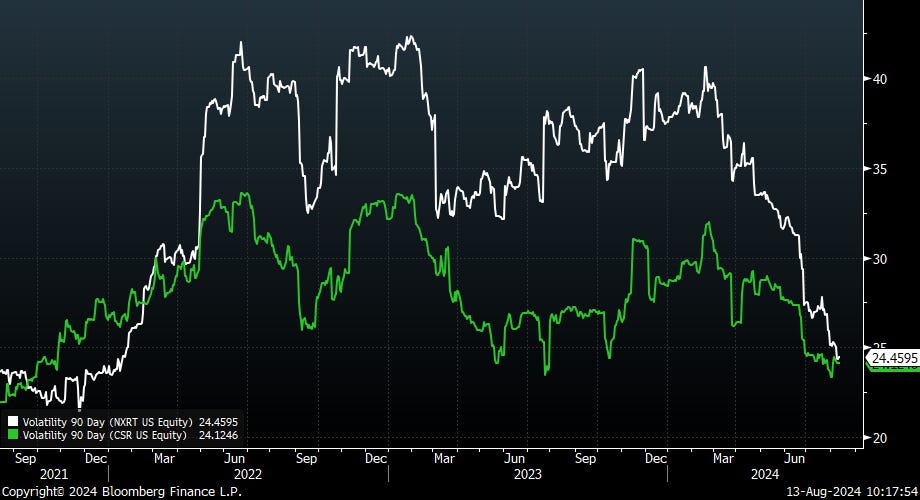

This creates a predictable but important impact on equity volatility. Centerspace is markedly less volatile than NXRT. Without too much of a digression, real estate investors who invest across public and private markets should note that higher leverage always increases equity volatility, whether those prices are marked daily by buyers and sellers or not.

This lower volatility means that underwritten returns driven by fundamental gains in NOI are higher fidelity than more leveraged alternatives. The volatility leverage creates means you have less visibility on your exit multiple, whether you are investing publicly or privately.

Outlook & Valuation

The thesis for CSR relies on relative top-line acceleration that moves the multiple closer to the comp set. If CSR can continue to print 3-5% rent growth as Gateway and Sunbelt markets go flat, the multiple should normalize despite the reduced leverage.

I have thus far not focused on supply dynamics. There is a well-understood narrative of increasing supply in the Sunbelt that will constrain rent growth over the next two years. The multiples of those REITs have begun looking beyond that supply wave and assuming a re-acceleration of growth after new apartments are absorbed.