Jaws Mustang 🔓

Barry Sternlicht is Buying Some Hotels from Barry Sternlicht, Subject to Approval By Barry Sternlicht

This post will include my usual disclaimers at the bottom, but I want to call out from the beginning that this is a dynamic situation involving illiquid securities with limited float and a prospective transaction mired in related party conflicts.

I cannot find precedent for what Barry Sternlicht is trying to do, so predicting various scenarios requires an unusual level of speculation. Additionally, Jaws Mustang is a Cayman Islands domiciled entity which further limits the predictability of outcomes. At best, this is a collection of facts from filings punctuated by open questions. Proceed with caution.

A Philosophy and a Platform for Change

Being a real estate billionaire obviously has its privileges but Barry Sternlicht, founder and CEO of Starwood Capital Group, is breaking new ground in the category. By mostly liquidating a SPAC but not terminating it, Sternlicht has created a valuable public shell into which he can place assets from his sprawling empire. An SEC filing disclosed that one of Sternlicht’s family office sponsored SPACs, Jaws Mustang Acquisition Corp. (JWSM), aims to acquire interests in a portfolio of Starwood Capital Group’s hotels.

Investment entities affiliated with Starwood Capital Group (collectively, the "Starwood Capital Entities") that own interests in a portfolio of hotels (the "Initial Portfolio") comprised of the 1 Hotels properties in Manhattan and Brooklyn, and the De Vere Portfolio in the United Kingdom, and Jaws Mustang Acquisition Corp (NYSEA: JWSM), a special purpose acquisition company ("Jaws"), today announced that they have signed a non-binding letter of intent ("LOI") for a potential business combination ("Business Combination"). Under the terms of the LOI, following the consummation of the Business Combination, the combined public company would be listed on a national securities exchange.

A few things make this deal interesting: a) Sternlicht owns virtually all of the outstanding shares of Jaws Mustang Acquisition Corp. and b) the 1 Hotels brand (philosophy, platform?) is his own creative passion project in the lodging space. After developing the W Hotel brand which he sold to IHG, Sternlicht dreamt up 1 Hotels as a “green” option in the luxury lodging space. Sternlicht, who is better known for railing against what he feels is Federal Reserve malpractice than promoting environmentalism, is quoted in the release,

I wanted to capture the beauty of nature in a hotel and commit to safeguarding it as best I can, a responsibility that I believe we all share. It's 1 world. But 1 is more than a hotel, it's a philosophy and a platform for change.

A Different Kind of Platform for Change

As for Jaws Mustang JWSM 0.00%↑ , it came public in the rah-rah SPAC environment of early 2021. A Sternlicht-related entity put up $25,000 for formation costs, receiving an aggregate of 25,625,0001 so-called Founder or Class B Shares. At IPO the entity raised over $1 billion including $22.7 million from Sternlicht’s family office via a private placement warrant offering.

In January 2023, Jaws Mustang issued a proxy extending its termination deadline by 12 months. At that time, shareholders could redeem their shares for the original $10 offering price. Virtually all of them did. As of the third quarter of 2023, the company’s most recent public filing, there were 2,103,614 Class A shares outstanding. The redemptions left the Trust account with just $22.7 million in cash.

Jaws Mustang Acquisition Corp., with no assets other than its cash, has a market capitalization of $300 million. The extreme premium to Cash-In-Trust is driven by the limited number of remaining redeemable Class A shares worth approximately $11 per share and 25,875,000 Class B Shares2 that are owned entirely by Barry Sternlicht.

In January of this year the entity filed a far more expansive proxy. It asked for permission to extend the termination period by another year to consummate a business combination. It also sought a change to the Class B shares that would allow holders (Barry Sternlicht) to convert to Class A shares immediately. The proxy was approved with a vote represented overwhelmingly by the Class B Founder Shares controlled by Sternlicht. On February 6th, Sternlicht converted 25,500,000 of his Class B shares to A Shares.

On Friday, March 8th, the proposed combination was announced.

The deal includes interests currently owned by Starwood Capital Group in The 1’s New York City properties and a UK portfolio of “eight iconic, historic country estates and houses.” The filing also suggests that the new entity would seek to acquire more 1 branded properties. The expected Net Operating Income (NOI) of the current portfolio is $62 million. An 8% capitalization rate, common for well-located hotel properties, would value them at approximately $775 million.

How might an entity with just $23 million in cash go about purchasing these interests? What duties does Sternlicht have to Starwood Capital Group investors? Most importantly, considering Sternlicht’s sizeable ownership of the public shell, is there an investable opportunity brewing?

The Trade

The remaining redeemable Class A shares3 can be redeemed in connection with the proposed business combination, which would leave the company without any cash. Yet, Jaws Mustang’s current structure gives Sternlicht $300 million of currency. Recall, he also owns 11,350,000 warrants with an $11.50 strike price.

Those warrants trade at just 18 cents today. The warrants are the most intriguing, yet unsettling element of this transaction. While not exercisable until 30 days after a business combination, the mathematical value of these warrants should be closer to $1.18.

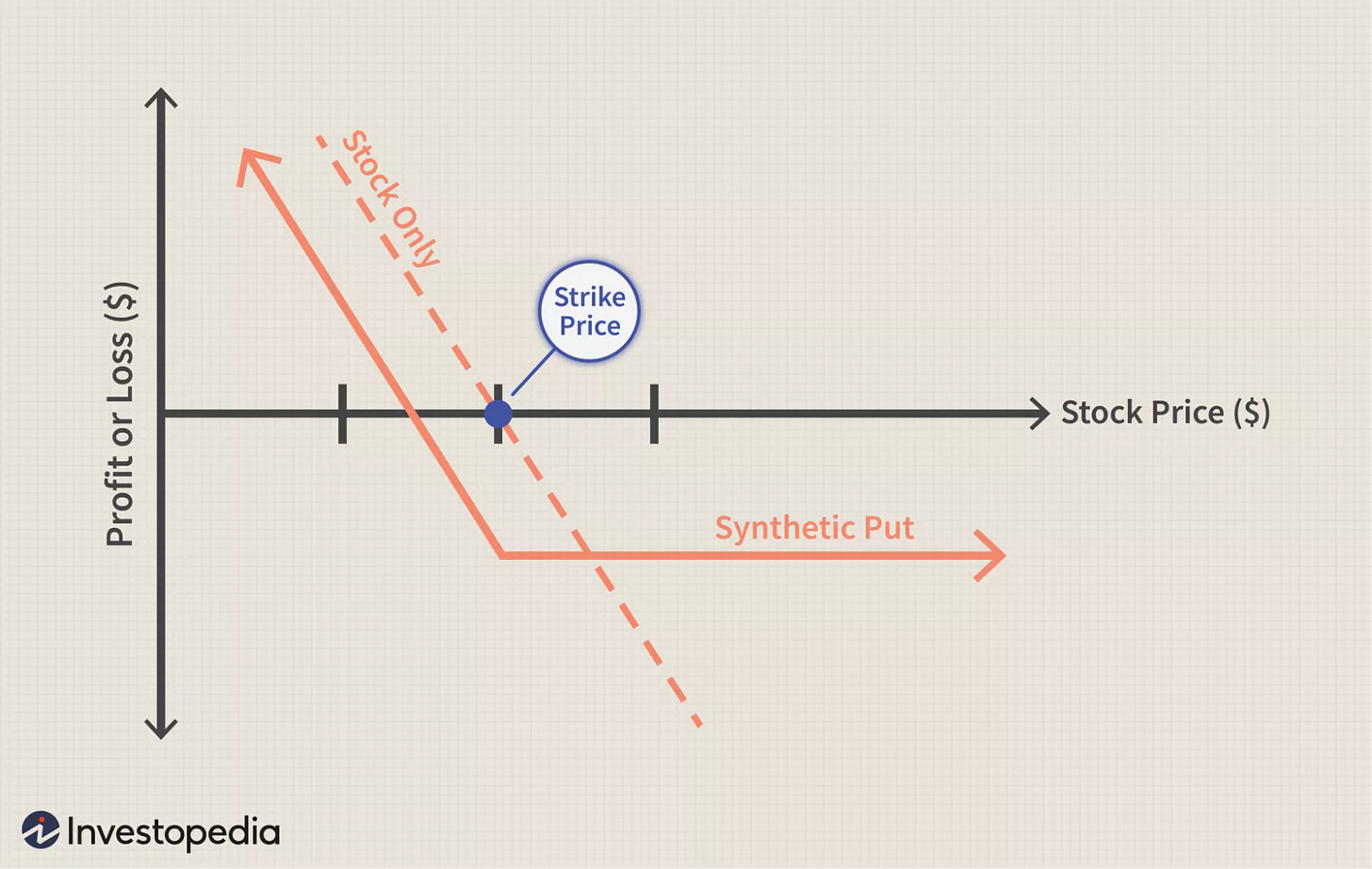

Shorting the common and purchasing the warrants, creates a synthetic put. But considering how optically mispriced the warrants are, purchasing more warrants than shorted shares create something that is similar to a long strangle.

Synthetic Put Diagram

Long Strangle

Should the common rise, the warrants will hedge the short with losses capped at the $11.50 strike price, the additional warrants offering uncapped upside. If the share price collapses, the short will be profitable less the relatively modest cost of the warrants.

There is obvious wisdom in shorting a shell company trading at 13 times the value of its cash. That you can hedge this short with warrants for just 18 cents and, assuming the transaction with Starwood is consummated, only risk 50 cents4 is anomalous. Sternlicht will likely need to issue shares to complete the proposed transaction. When you additionally consider that the warrants include a provision to adjust their strike price downward in the event of a share issuance, it becomes perverse.

If share issuance occurs at a price below $9.20 and the new equity represents more than 60% of the equity in the business combination, the warrant’s strike price is adjusted to 1.15x the new price of the shares. That means that both the short common and long warrant could be profitable.

Even if he can convince the market of the value of “The 1” brand/platform/philosophy, there is considerable overhang from the current $300 million market capitalization. As newly issued shares begin to float the price of the common should collapse. When it does, the short would pay off handsomely even accounting for the cost of the warrants.

That said, Sternlicht is not your typical SPAC sponsor, or perhaps, he is your prototypical SPAC sponsor. He can, seemingly with ease, be on CNBC or Bloomberg talking about capturing “the beauty of nature in a hotel.” He also has a big office at Starwood Capital Group headquarters, the counterparty of his proposed business combination. Through a creative share-based transaction I can only vaguely conceptualize, he could move the value of these hotels into Jaws Mustang in such a way that the shares retain value. He’s already succeeded at having $23 million of cash trade like it’s $300 million.

Sternlicht’s sponsor entity has been extending forgivable promissory notes to cover the administrative costs of the SPAC. Aside from these small loans and initial $25,000, the $22.7 million Sternlicht paid for his warrants is his only investment in Jaws Mustang. He has created a high margin of safety for his capital in this structure. If by some miracle of financial engineering he can complete the transaction5 and get the share price to $11.51, the combination of his common and warrants would turn $22.7 million into over $400 million.

While this seems like a lot of effort to bring a few boutique hotels public, it would create a form of liquidity for Starwood Capital Group investors at a time when real estate transactions are muted. Of course, it also happens to have the key feature of massive upside for Barry Sternlicht.

Even with heavily dilutive share issuance, assuming the warrant strike price is adjusted downward, Sternlicht has created an absurdly asymmetric vehicle through which to bring these assets to market. Similar asymmetry is potentially available to brave investors via the warrant arbitrage.

The caveats and footnotes that could accompany the above are extensive. In brief, as more details of the transaction emerge, the fate of the common and Sternlicht’s $23 million will become clear. The apparent warrant arbitrage will disappear one way or another.

Could the common get squeezed through redemptions before the warrants are able to be exercised? Yes. Are the warrants worthless paper considering the redemption terms and likely degree of dilution? Very potentially. Does the Cayman entity afford Sternlicht a high degree of flexibility? The filings say as much!

Is anyone looking out for Jaws Mustang Corp. shareholders? Yes, ironically. Barry Sternlicht is almost certainly looking out for himself.

Disclosures

This report is intended to be educational and entertaining, not investment advice. Do your own due diligence. I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report.

Any assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. Lewis Enterprises is not acting as your financial advisor or in any fiduciary capacity.

At the time of this writing, I own Jaws Mustang Warrants and am short Jaws Mustang common stock in an approximately 7:1 ratio. My own positioning is subject to change without notice.

Jaws Mustang Acquisition Corp. is one of five Special Purpose Acquisition vehicles Sternlicht launched between 2020 and 2021. Cano Health which combined with Jaws Acquisition Corp (JWS) filed for bankruptcy and was formally delisted in February of this year. Velo3D of which Serena Williams is a board member combined with another Sternlicht SPAC, Jaws Spitfire (SPFR). Its shares are off 92% from their pre-merger price.

Ultimately, Sternlicht ended up with 25,875,000 Class B Shares

Subsequently converted to Class A shares following the proxy.

His conversion to Class A shares gives him 92% control of the class, and per the Cayman entity can “vary” the rights of the Class. Although filings suggest he cannot alter the redemption rights.

The current $11 share price to $11.50, where theoretically you could cover the short with shares from exercising warrants.

There is presumption that Sternlicht may have more fiduciary duty to the Starwood Capital Group owners who currently own these assets than he does to the shareholder (or warrant holders) of this listed Cayman shell company. The degree of related party dealing in this between Sternlicht’s family office, a public entity and his private investment firm is egregious. “The Line” to the degree that there is one, already appears distantly in the rearview.

Do you have any updates considering 7 months have passed since you wrote the article? Thanks.