Welcome to a new, more frequent offering that looks at how past themes I have covered are playing out and notes on real estate trends I am monitoring. I am running a special for monthly subscribers to upgrade to annual subscriptions for 30% off the normal annual rate. That offer is available just below the paywall.

In this issue:

Mortgage REIT Fixed-to-Float Preferreds

Real Estate Credit Commentary Across Public and Private Markets

Cushman & Wakefield Earnings Report

Hotel Unionization Trends

Fixed-to-Float Preferreds

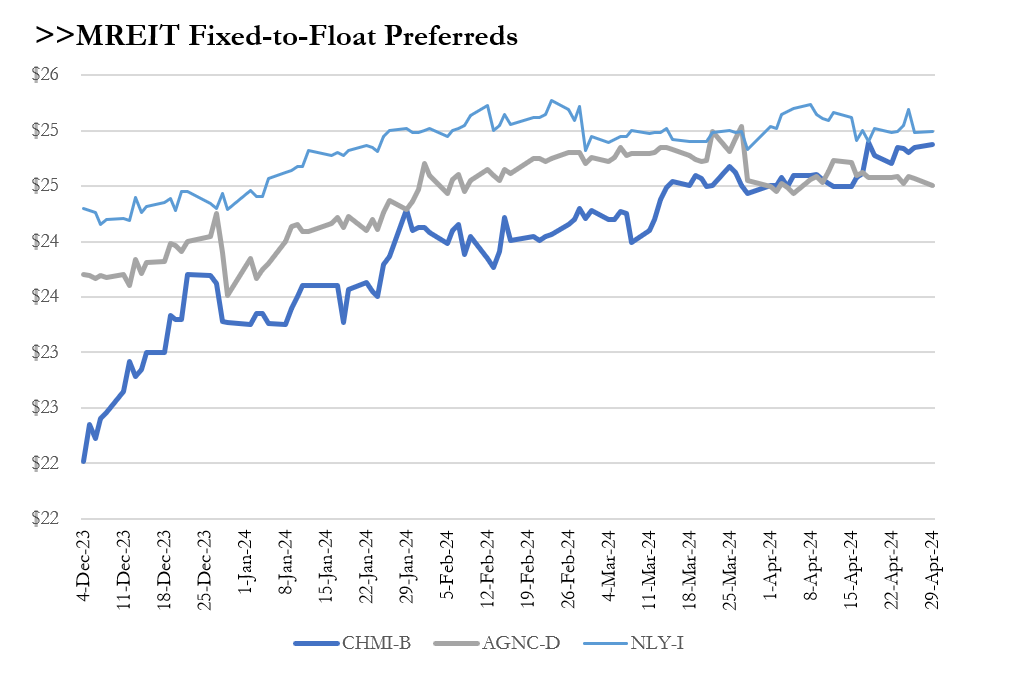

In December, I flagged a handful of Mortgage REIT fixed-to-float preferreds coming up on their float date. The logic of these was fairly straightforward: They paid ~S+500 coupons upon float but it was unlikely they would be called as they couldn’t be refinanced for much cheaper, plus they would already benefit in the event of rate relief from the Fed. Holding these as they approached the float date and beyond provided low duration with high yield.

As expected, these have accreted mostly to par or above and now pay between 9-11% coupons. I will keep my eye on the next batch of float dates for MREIT preferreds across 2024-2025. While these were not the most exciting securities on offer, they have outperformed both the broader REIT indices and the U.S. Aggregate bond index since the write-up.

Preferred Equity Commentary

In private real estate markets, difficult refinancings are forcing the re-engineering of capital stacks to extend existing low-rate senior debt by supplementing with much costlier preferred equity/mezzanine layers.

Large asset managers like KKR KKR 0.00%↑ , Apollo APO 0.00%↑ & Blue Owl OWL 0.00%↑ have set up real estate-specific credit funds, meeting investor demand to “check the credit box” regardless of underlying risk profile. In fact, across asset classes, there is a strong bid for credit. High-yield spreads are back to early-2022 levels, and BDCs have outperformed the broader equity market over the past year.

In public real estate markets, REIT preferreds have been building a performance lead against equity. Back in December, I wrote up the situation at Hudson Pacific Properties HPP 0.00%↑ . I continue to believe that deleveraging through property sales or an outright spin of the studio business will improve the position of preferred. Those shares have risen from $12.50 to just over $14 today. More importantly, they reflect a key distinction between public and private credit investing in real estate.

In private real estate, preferred equity and common equity are relatively aligned as improvements to NOI are good for preferred and equity holders alike. In public real estate, where preferreds are balance sheet financing for the entire portfolio, there are often opportunities where certain transactions can be good for preferred holders but bad for common equity. Deleveraging the balance sheet can mean selling off NOI to remove secured debt that sits above the preferred -- bad for equity, good for credit. Preferred investors should look for these scenarios where you are playing for an improving credit position, not simply improving debt coverage.

I think we are approaching an inflection point both across public and private real estate, where the relative risk and reward may soon flip back to equity from credit. Preferreds benefit from a higher debt yield on a lower implied basis, but the larger they become as part of the capital stack they begin carrying equity-like risks with a capped upside.

Let’s take a simplified example of senior LTVs moving from 60% to 50%. The new deal for preferreds puts their coverage ratio close to 1, while an improvement in NOI disproportionately benefits equity (holding property value constant). Preferred’s coverage improves mildly, while equity cash-on-cash more than doubles.

In fairness, most preferred equity yield is split between a cash-pay and accrual which changes the actual timing of the equity cash flows but doesn’t inherently change the economics. Unless you are playing for control of the asset at a lower basis, it’s making less sense to give up the upside for a nominally improved position on the capital stack.

Cushman Earnings

Cushman CWK 0.00%↑ reported tepid earnings last night. I continue to believe the franchise is worth more to a strategic acquirer than it is to shareholders. The basis of that belief was that Cushman could not fundamentally grow while both cutting expenses and attempting to deleverage.

The company is levered 8x Net Debt-to-EBITDA, versus 2-3x for JLL and CBRE. The call revealed that the company’s cost-cutting measures are now fully baked and any performance improvement relies on a recovery of the CRE market.

This is a company that powered growth through acquisitions, which is simply off the table until the company significantly improves free cash flow and effectively de-levers. Borne of private equity, sponsor TPG, and its partners represented a large portion of the board, several of those seats have recently turned over to non-conflicted seats. I believe Cushman would make an excellent candidate for a soft-activism campaign that pushed for an exploration of strategic options.

Hotel Unionization / Outlook

Noticed this interesting article on CoStar about how the growing unionization trend could impact hotel owners. The key point here is a change the NLRB made to the definition of collective bargaining units.

Before this change, employers would argue that employees could vote to unionize, but because they had a community of interest in the hotel, they would have to get 50% plus one of every eligible employee in the hotel to vote in favor of unionizing.

‘The front desk, food and beverage, housekeeping, and engineering all have a community of interest in the running of this hotel, so they should all have a say in whether they’re unionized,’ she said.

Under the reinstated standard, individual departments of a hotel’s operations could unionize, she said. It’s much easier for unionization to win when they’re working with smaller units, and then there’s greater potential for the other departments to follow suit.

Lodging REITs are among the better-performing real estate sub-sectors this past year, as they have been able to push average daily rate (ADRs) on the back of a strong consumer, absorbing a good portion of cost inflation. Unionization would be a secular, as opposed to cyclical, cost driver. The lodging sector is uniquely fissured between property owners, brand owners, operators, and sub-contractors. Should unionization begin rippling through this value chain, I would expect bitter fights among these stakeholders for who, exactly, takes the attendant hits to their margin.

REIT Subsector Performance as of 4/29