"God didn't create a perfect world a priori. He created a world with time and in some sense enabled or engendered time to work its magic."

Several years ago, I wrote a post titled “Toward Shores Not Yet Visible.” The title was taken from a line written by Perry Mehrling:

“The web of interlocking debt commitments, each one a more or less rash promise about an uncertain future, is like a bridge that we collectively spin out into the unknown future toward shores not yet visible.”

The piece was, to put it mildly, poorly received. It was too heady, too philosophical, or maybe just poorly written. My goal was to explore how we use finance to contend with our inability to predict the future and the temporal nature of finance, which is both defined and affected by the passage of time. I wanted to use philosophy and metaphysics to make a point about finance.

Sometime later, I began reading Zohar Atkins, a rabbi, philosopher, and poet who was using financial concepts in his writing as a grounding point for teaching philosophy. We both had the same notion: That financial markets reveal something crucial about human experience. They aren’t simply abstractions designed for value capture.

Our conversation covers a variety of topics including optionality, Buffett, and the cultural impact of “spiritual ZIRP”. Perhaps most counterintuitively, philosophical skepticism emerges as a market advantage. Atkins provocatively states that

"Being a stock picker is cringe... the chances of you being wrong and overstating your expertise and getting outside your circle of competence when you think you're inside of it are quite great."

Instead, "Humility might be the thing that allows you to buy Carvana when it's trading at two bucks a share. Because what you're really betting on is the possibility that consensus is way wrong."

In today's hyper-connected world, social media has "turned everybody into a day trader of opinion," creating reflexive loops where our thoughts and beliefs rapidly fluctuate based on external feedback. Amid this volatility, perhaps the wisdom of ancient skeptics offers not just philosophical insight but practical advantage.

The language of finance provides powerful metaphors for understanding our existence, while philosophical frameworks help us navigate market complexity with wisdom.

As Atkins concludes, humans are like spiders "caught up in a web of significance" that we ourselves have spun—constructing meaning through both financial and philosophical frameworks that, together, help us chart a path through an uncertain world.

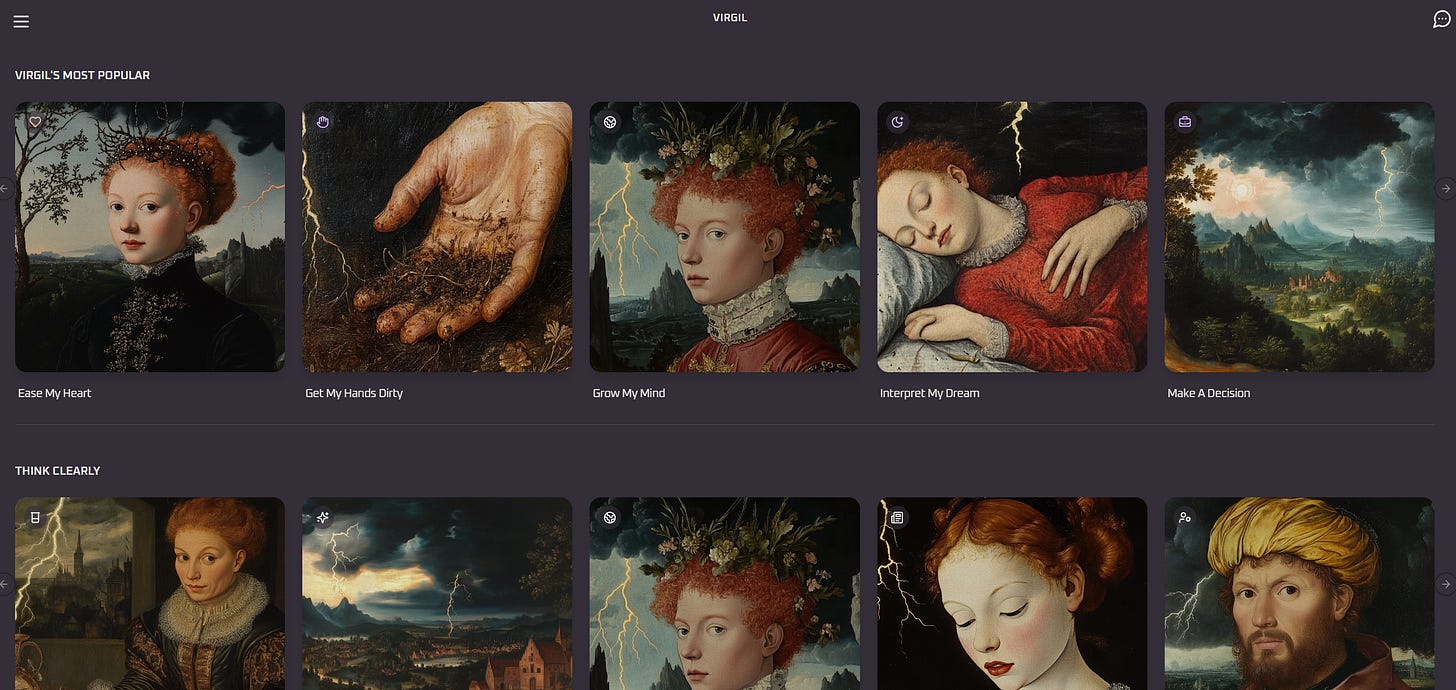

Finally, we discuss Atkins new project, Lightning, an AI-based LLM called “Virgil” loaded and trained on the texts of great philosophers. Unlike most LLMs trained on sycophancy, Virgil is Socratic, responding to your questions with deeper questions and guidance from history’s greatest thinkers. The experience starts with a 30-question quiz that matches your current philosophical framework with philosophers that are both most aligned, as well as those that will most challenge you.

You can get a sense of the role Lightning could play in your own intellectual journey via a new Substack that Zohar has launched:

In the end, markets and metaphysics share a common truth: both are human attempts to navigate uncertainty through time. The real wisdom may lie not in claiming certainty, but in embracing the humility that comes with recognizing our limitations.

In this light, both finance and philosophy become not competing disciplines, but complementary languages for describing our shared journey into the unknown—bridges we collectively spin toward shores not yet visible.