Inside the Private Equity Options Factory

GP Stakes Investing and Financialization of Private Capital

The emergence and growth of GP Stakes investing is the latest of late-cycle phenomena, a motley chimera of structures used to amplify the productive output of the private equity options factory.

When you take out a mortgage to buy a home, you are shorting the bond market to go long housing. When you pay life insurance premiums you are rolling a put option on your life expectancy. Recently in Europe, I was offered the opportunity to pay for dinner either in US Dollars or Euros at an exchange rate that reset nightly, innumerate travelers no doubt creating a nice spread business for someone.

Most everyday transactions are really financial abstractions. It is not necessary, or even practical, for people to think in these terms. You do not need to run Black-Scholes on your international bar tab. They are useful simplifications that reduce the inherent frictions of global trade. For financial markets, these transactions are the raw material for instruments that hedge, speculate or leverage capital into more capital. For financial market participants, breaking investment returns down to their component parts and understanding them isn't just an interesting thought exercise -- it's the entire job!

Private equity is no exception, neither in its aims nor its abstractions. Said plainly, as interest rates fell, allocators at large capital pools needed highly levered exposure to equity beta but were institutionally incapable of tolerating the attendant volatility. Private equity offered to abstract away that volatility in return for a compensation structure that created an asymmetric payoff for the sponsor: An option.

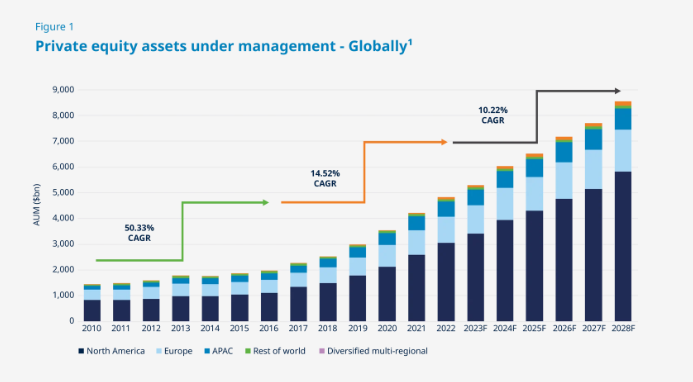

Creating a structure where LPs could effectively sell volatility has been a runaway success across asset classes. In 2012, private capital fundraising was under $500 billion annually, in 2022 that figure was $1.4 trillion. Growth of private capital has meant a proliferation of alternative asset management firms in increasingly niche markets. Meanwhile the upper tier of the market has been consolidating1. As I wrote in The Distribution Layer, "The largest managers have provided a release valve for unprecedented liquidity but now find themselves with a similar deployment challenge as the capital they manage." Non-control stakes in emerging firms “GP Solutions” or “GP Stakes Investing” solves a deployment problem with an elegant, high operating leverage solution.

In a typical structure a private equity firm, the GP, earns a management fee but more importantly begins to participate in the profits above a predefined hurdle rate, "the carry". The investor, or LP, is effectively ceding this portion of their profits to the GP. This ceded value was "sold" in return for the productive efforts of the GP, the benefits of being a limited partner wherein the maximum loss is contributed capital and for laundering the volatility of the underlying investments.

In theory, the GP takes on greater risks in this arrangement, exposing herself to legal liability, possibly staking unrelated assets or operating the partnership at a loss in the hopes of breaking into the carry. The theoretical portion is that sponsor size and creative structuring has largely negated these risks for most institutional GPs. Today the market, like many, is one of brands, access and relationships. Risks to institutional GPs, to the degree they exist at all, are largely reputational.

Take this entire dynamic, nest it inside of itself and you have GP Stakes investing. Asset management firms raise funds to purchase interests in other, usually smaller or middle-market, alternative asset managers. Institutionalized GP stake investing was pioneered by Goldman Sachs' Petershill Partners. Goldman set up the unit in 2007, bringing it public on the London Stock Exchange in 2021. In practice, family offices have done some form of the strategy for decades.

Initially, there was a degree of adverse selection and misalignment with investee LPs as the deals were more akin to aggressive financing structures that offered a little capital for large interests in the management company. Today, the strategy is positioned as "GP Solutions" with more manager-friendly structures and ancillary support to grow the business. As defined by alternative asset manager and leading GP Stakes investor Blue Owl (Dyal),

A minority owner’s interest is usually permanent and entitles the holder to a share of the GP’s cashflow, which is generated by the fees and carried interest charged on the GP’s funds as well as returns made from investments on the GP’s balance sheet (i.e., the GP’s co-investments in its own funds).

Why would the largest asset managers pursue this strategy and why would a growing alternative asset manager be interested in selling off a portion of their management company? Not surprisingly because it is a novel form of leverage for all involved. The emergence and growth of GP Stakes investing is the latest of late-cycle phenomena, a motley chimera of structures used to amplify the productive output of the private equity options factory.

The Commenda Then and Now

Every industry, including finance, is beguiled with the notion of building "platform" businesses, consultant-speak for an asset light structure that collects economic rents from intellectual property. For private equity, the intellectual property is not so much novel methods or technology, but rather the brands, reputations and relationships that generate deal flow and raise capital. Deal flow, that once extruded through the private equity form, creates the option-like security of the GP stake. This creation of new financial assets is nearly totally abstracted from the underlying asset owners, the pensions, endowments and now high-net worth investors that are fund-level LPs.

When viewed as an options creation exercise, the incentives for private equity sponsors begin to look different. The earliest origins of what we know today as private equity began with Italian merchants and the commenda2. A land-based merchant (the stans) would entrust a seafarer (the tractator) to ship goods to another port, sell them and return with the profits. In a unilateral commenda ( a mere-commenda) the tractator would be entitled to somewhere between one-quarter to one-third of the profits. In a bi-lateral commenda, or one in which the tractator also contributed capital, the profits would be split 50/50.

This structure sought to align the incentives of the parties at every level. The tractator was taking on significant, possibly mortal, risks. The stans, or merchant, could not compound capital in a local market, and as their wealth grew, would need to trade in progressively further markets. The stans risked their capital and bore 100% of the financial losses, while the tractator's time, talent and appetite for danger afforded them upside with no financial commitment. Capital and labor thus came together in a mutually beneficial arrangement. That broadly the shape of this arrangement persists today speaks to its natural logic, "lindy" as it were.

This logic is distorted however when the goal is no longer the generation of investment returns, but rather the generation of ever more commenda contracts. With risks to the GP all but eliminated, bootstrapping options and then further selling off stakes in the bootstrapping operation begins to significantly divorce itself from the goals of investing capital. Many GP stake deals come with a follow-on commitment to provide regular-way LP capital to future funds, a further enticement to grow and deploy LP capital.

Of course, every asset management firm wants to grow but a natural constraint on growth is investment performance. If a firm's investments perform, they can attract more assets, the profits from realized carry helping to support the growth of the organization to invest the now larger pool of capital. A large and growing base of capital buying GP stakes distorts this important feedback loop of capital allocation. Selling a GP stake is quite literally borrowing the rewards from unknowable future investment returns. Per consulting firm Maketa,

The primary purpose referenced by GP stakes managers for minority transactions is to provide capital for growth initiatives. This additional capital might be used by the GPs to make a larger commitment to their funds (to enhance the alignment of interest with LPs), to establish new products (which may require the addition of new teams), or to expand platforms (e.g., targeting a new asset class in the private markets or a new geography).

Private equity firm GCM Grosvenor says that can the "[h]alo effect from institutional capital provides critical validation to the manager in a highly competitive market for capital and talent." Then, without the vaguest sense of irony points out,

For LPs, one of the most compelling cases for seeding is historical data that demonstrates outperformance of earlier fund vintages. Based on aggregated data for buyout funds, a Fund I net IRR outperforms established private equity funds by an average of ~280bps

So GP stakes are great way for private equity firms to accelerate their journey to mediocrity? The GP stake investor has effectively bought an options creation platform. Spread across enough managers and fund vintages this creates a perverse form of leverage. LP capital is grist for the mill in which losses in the underlying funds are pushed down to LPs, while the upside ascends through layers of waterfalls. Attempts to reconcile incentive alignment are increasingly futile as the system becomes preoccupied with the creation of financial assets to the detriment of prudent capital allocation.

Victorian banker, essayist, and journalist Walter Bagehot wrote, "[w]e must not confide too surely in long-established credit, or in firmly-rooted traditions of business...We must examine the system on which these great masses of money are manipulated, and assure ourselves that it is safe and right.”

Capital without an economically productive home will resort to the creation of financial securities and abstracted layers of risk re-distribution. Private equity, long exhausting the gains from levering up equity beta, has resorted to increasingly arcane structures to solve a growing deployment problem. Un-abstracting those structures reveals simply more exotic forms of leverage.

The seductive allure of present credit, and the crushing burden of future debt, are two faces of the same creature.

- Perry Mehrling

Further…

L.E. Memo | The End of Thrift

Public markets, not unlike public libraries, offer a clear social benefit yet if they were not already established it is hard to imagine their creation in the present. That a median wage earner with relatively little administrative friction can purchase equity stakes in some of the “best companies in the world” is beautifully egalitarian.

Toward Shores Not Yet Visible

We must examine the system on which these great masses of money are manipulated, and assure ourselves that it is safe and right. - Walter Bagehot The subtext, and occasionally the denotation, of discussions about finance is a shared idea of properly functioning markets.

The Zero-Coupon Convertible

“The most beautiful thing that ever shouldered a load! It rides and handles like a convertible yet hauls and hustles like the workingest thing on wheels.” - Chevrolet Motor Company

Personally love GP co-investing but it reflects the increased commoditisation of investing and liquidation of illiquid markets. The risk-shifting between groups of investors breaks the linkage between the risk of the underlying asset and the responsibility from the original group of investors to prudently invest. To whit the best comparison is the securitisation of mortgages (risk shifting) creating an origination to distribute model that incentivised one group (originators) to make loans even though the mortgage market was functionally insane because their returns were predicted on the volume of loans not the quality of those loans.

A thoughtful essay on an under-discussed -domain of private equity.